While financing sources appeared to return to form in early 2022, volatility in the capital markets ultimately throttled down deal volume in the second half of the year.

By Jeff Shaw

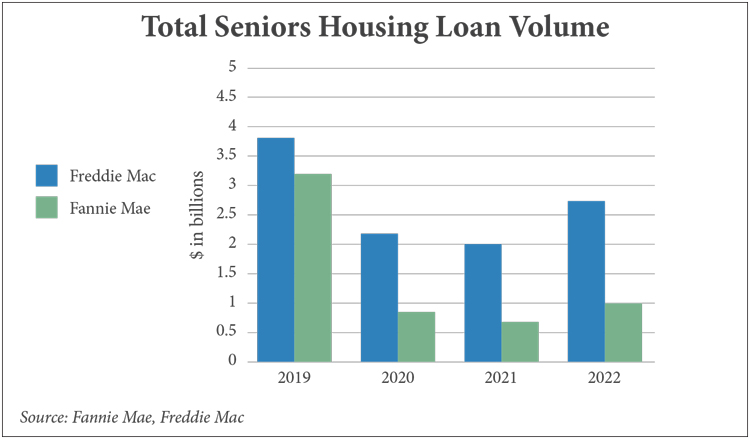

At first glance, 2022 looks like a partial return to pre-pandemic form for Fannie Mae and Freddie Mac’s deal volume within the seniors housing sector. After major downturns in 2020 and 2021, Fannie Mae’s volume rose 26 percent from $800 million in 2021 to $1 billion in 2022. Freddie Mac’s volume rose 29 percent from $2.1 billion to $2.7 billion over that same span.

While these numbers still pale in comparison to 2019 — when Freddie closed $3.8 billion and Fannie closed $3.1 billion — it still signaled that the government-sponsored enterprises (GSEs) might be on the rise.

Unfortunately, that’s not the whole story. Strong results in the first half of 2022 were tempered by rising interest rates in response to out-of-control inflation.

“Going into 2022, I think everyone was hoping for stronger lending activity,” says Christopher Honn, managing director at NewPoint Real Estate Capital. “But Fannie Mae and Freddie Mac ended the year well below their historical pre-pandemic volumes.”

Honn served as Fannie Mae’s seniors housing product manager for nearly 13 years, from February 2002 to December 2015. He notes that the struggles felt in the back half of 2022 have spilled over into 2023 and that industry professionals should expect much of the same this year for lending.

“We are already into the beginning of the second quarter, and year-to-date deal flow signals the challenging lending environment continues as a result of the market volatility and uncertainty.”

For its part, Freddie Mac expects seniors housing loan volume in 2023 to surpass deal volume in 2022, according to Steve Schmidt, the agency’s senior director of seniors housing.

“Balancing the tailwind from the continued seniors housing recovery against the headwind from the recent dramatic increase in interest rates, we expect our volume in 2023 will only increase slightly. Overall, the industry continues to recover, and the demographic growth is undeniable, so we’re optimistic about seniors housing in the years ahead.”

Schmidt retired on March 31, after this interview was conducted.

Interest rates cause ripple effect

On March 22, the Federal Reserve raised its short-term interest rate by 25 basis points, continuing its campaign to slow inflation despite financial turmoil following Silicon Valley Bank’s collapse. The Fed’s ninth consecutive rate hike boosted the federal funds rate to a target range of 4.75 to 5 percent.

While this is not a historically unprecedented rate, the speed at which the rates rose was a shock to the lending system. Fannie and Freddie certainly are not immune to that shock.

“It’s simple math,” says Schmidt. “If net operating incomes (NOIs) are constant and interest rates rise, every new loan will be further constrained by industry standard debt-service coverage ratios. The rise in interest rates was so dramatic it put many deals on the fence.

“Most borrowers looking to refinance are trying to achieve at least cash-neutral proceeds, and many deals no longer pencil out to that at higher interest rates. The same goes for acquisitions. Many were put on hold as higher interest rates meant a lower return on buyer’s equity, unless the seller was willing to accept a lower purchase price.”

“The short-term impact is tremendously reduced production by volume and buy-sell activity,” adds Honn. “How long will this last into 2023? Listening to the summary of the Fed chairman’s comments recently, rates look like they’re going to keep going higher, putting continued pressure on loan production and acquisitions.”

Perhaps the biggest challenge for lenders is the uncertainty of how long this volatility in the capital markets will last. Honn notes that lenders use stress-test underwriting standards, basically planning some buffer for changes such as increasing interest rates. But the sudden run-up in rates means some lenders are getting dangerously close to their own fail-safes.

“Especially at the bank level, you have a constant test of debt-service covenants. It makes it very difficult to size loans today,” says Honn. “The questions for lenders are: ‘Where is the ceiling? Is this the right stress-test rate? Should we put more cushion on what we’re doing?’”

In its press release regarding its end-of-year 2022 seniors housing volume, Fannie Mae didn’t sugarcoat the challenges.

“The company’s seniors housing portfolio has been disproportionately impacted by recent market conditions. A sharp rise in short-term interest rates during the latter half of 2022 put additional stress on [the Fannie Mae] seniors housing portfolio that was already experiencing elevated vacancy rates compared to pre-pandemic levels and higher operating costs exacerbated by higher inflation in recent periods.”

The press release goes on to note that 40 percent of Fannie Mae’s seniors housing mortgages feature adjustable rates, which are impacted by the recent run-up in rates.

What is a perfect borrower?

When it comes to risk management, Fannie and Freddie both agree with a common refrain in the industry: It’s all about the borrower and its operator.

“Freddie Mac has always been highly focused on working with financially strong and experienced seniors housing owners and operators,” says Schmidt. “That has served us well during the pandemic and in today’s economic environment.”

Honn notes that the GSEs have gotten stricter on analyzing the borrower, the operator and the property in recent years.

“There have definitely been changes,” he says. “There’s greater focus on sponsorship and their experience, and greater focus on the operator and their experience. Market and submarket analysis is deeper than ever.”

Honn adds that the agencies are “being extremely cautious” and are analyzing factors such as rent growth, expense growth and NOI margin more carefully than ever before.

A factor that’s even more important to the GSEs than most lenders is affordability because a part of their mission is to fund affordable living for Americans.

Honn says that one resource borrowers can leverage is in-house affordability calculations at both Fannie and Freddie.

An owner looking for a loan can find out quickly and easily whether its property will qualify under the GSEs’ mission of affordability.

“The affordability component is critical,” says Honn. “There’s a model both agencies have that plugs in the information we send them. They quickly find out what the affordability goal is on that property. If you’re looking at financing a property now that made it through COVID, there’s a very comprehensive analysis on month-by-month performance.”

“Strong seniors housing transactions are those that help us meet our affordability mission and are safe and sound,” adds Schmidt.

“The first factor is always whether the deal has a financially strong and experienced seniors housing owner and operator. After that we look for quality communities trending positively with 85 percent or more occupancy, and in areas where occupancy is improving and there is little risk from competition coming online.”

One silver lining, Schmidt notes, is that the much tighter underwriting standards put in place on a temporary basis during the COVID-19 pandemic have ended, and underwriting has returned to normal.

“During the pandemic we underwrote at lower-than-in-place NOIs, as we anticipated the NOI downturn that was going to come from occupancy declines due to lockdowns and the absence of vaccines,” says Schmidt. “Since the pandemic is largely under control and seniors housing occupancies and rents are slowly improving, we’ve returned to underwriting in-place NOIs.”

Accounting for active adult

Active adult has been one of the hottest and fastest growing segments of seniors housing in recent years. However, until recently the exact definition of “active adult” was unclear.

The National Investment Center for Seniors Housing & Care (NIC) in October 2022 released an official description for active adult: “age-eligible, market rate, multifamily rental properties that are lifestyle focused; general operations do not provide meals.”

As far as Fannie and Freddie go, the organizations are gearing up to improve their classification structure for active adult. Shortly after NIC released its new definition of the class, both agencies agreed on a new process for handling active adult loans.

Prospective borrowers will send active adult loan proposals to the seniors housing team at Fannie or Freddie. That team will comb through the information and determine whether the property should be classified as active adult or private-pay seniors housing (independent living, for example). Following that decision, active adult loans will be forwarded to the general multifamily divisions, even if the borrower is primarily a player in standard seniors housing.

“That’s great clarification that we finally have in that process,” says Honn. “Maybe eventually what will happen is the multifamily production will be more segmented, like it is between

market-rate and affordable housing. I don’t know if it will happen or not, but I hope it does. There may become an active adult subset of multifamily.”