DALLAS — A clear majority of respondents to CBRE’s U.S. Senior Housing & Care Investor Survey conducted in October reported either no change or a decrease in capitalization rates from the prior survey in April.

Meanwhile, the industry outlook for rent growth is less bullish than it was a short time ago as more survey respondents in October predicted flat rent growth in the year ahead, with April’s poll findings.

Administered via e-mail in October, the 15th edition of CBRE’s survey polled the same group of seniors housing real estate professionals and investors as the April survey, achieving a 96 percent response rate. All told, there were more than 50 respondents to the survey that focused on six product segments starting with active adult and advancing to skilled nursing and continuing care retirement communities.

Among the key findings in the October installment of the survey:

• Some 54 percent of respondents reported no change in senior housing cap rates from the April survey. (Cap rates are an important metric for investors to compare different properties and assess whether a property is undervalued or overvalued based on its potential income relative to its price. Falling cap rates are an indication of rising prices, for example. The cap rate is calculated by dividing the annual net operating income by the purchase price.)

• Based on total responses, the average senior housing cap rate fell by eight basis points over a six-month period.

• Skilled nursing cap rates decreased by seven basis points on average between April and October, after increasing by 11 basis points over the previous six months.

• The average cap rate for active adult communities decreased by 11 basis points between March and October, nearly offsetting the increase recorded during the prior survey.

• Independent living and assisted living cap rates both fell by an average of 10 basis points, while cap rates for memory care facilities showed no change.

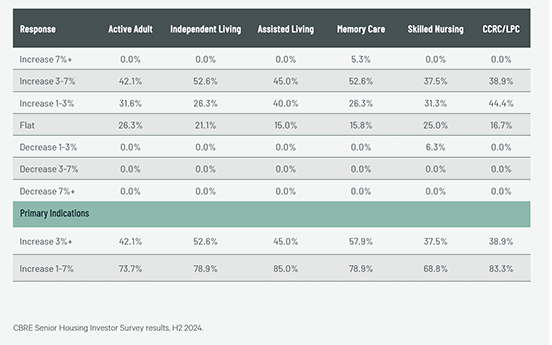

• For active adult, independent living, assisted living and memory care communities, 48 percent of survey respondents indicated they expect rental rate increases of 3 to 7 percent over the next 12 months, down from 63 percent of respondents in the prior survey. Approximately 26 percent of respondents expect no rent growth for active adult communities in 2025.

• No respondents reported underwriting rent growth above 7 percent compared with 12 percent of respondents who did in the April survey.

“The fundamentals of the seniors housing sector are improving, driven by constrained new supply and surging need-based demand. Investor sentiment appears to have reached an inflection point, as the demand for well-performing assets is gaining momentum,” stated Daniel Lincoln, executive vice president for Dallas-based CBRE Valuation & Advisory Services.

“Despite the recent bond market volatility, the majority of investors reported no change in cap rates, which is consistent with trends seen in other sectors like multifamily and industrial,” explained Lincoln in a follow-up e-mail to Seniors Housing Business.

“It was somewhat surprising to see cap rates remaining flat or even compressing in some instances, especially considering the tempered outlook for rent growth expectations compared to previous surveys,” he added.

Rent growth expectations

The October survey did not provide a clear consensus on rent expectations. In contrast, the April survey resulted in a consensus expectation of 3 percent rental rate growth over the ensuing 12 months.

No respondents in the October survey expected a rent decrease for any asset class except for skilled nursing.

The number of respondents expecting no change in rental rates increased to approximately 20 percent in October compared with nearly none in April.

The percentage of respondents who reported underwriting rent growth above 7 percent fell from 12 percent in April to zero in October.

The full report can be found here:

https://www.cbre.com/insights/reports/us-senior-housing-and-care-investor-survey-h2-2024

— Matt Valley