With operational history in its front office, the publicly traded REIT is succeeding where others have feared to tread — skilled nursing. By Jeff Shaw The skilled nursing sector faces some unique headwinds. As the most healthcare-heavy form of seniors housing, nursing homes require intense specialization on the part of operators. The falling occupancy rates stemming from COVID-19 have put enormous strain on operator’s net operating income. NIC data shows skilled nursing hit an all-time low of 70.7 percent in January, compared with 80.7 percent for independent living and assisted …

From The Magazine

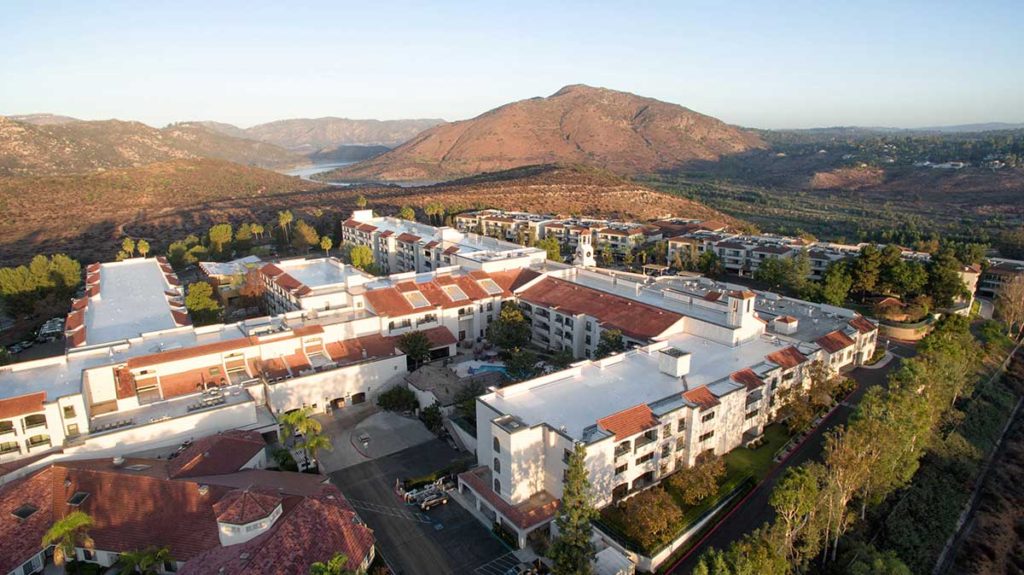

Life plan communities outperform other types of seniors housing amid the pandemic due to an increased focus on choice and long-term residents. By Jeff Shaw The 2008 housing market crash, also known as the Great Recession or Global Financial Crisis, hit one segment of seniors housing particularly hard: continuing care retirement communities (CCRCs). The CCRC, or life plan community, concept is a campus with a full continuum of care — from independent living through skilled nursing — where residents can continue to live at the community as their acuity increases. …

Seniors housing specialists must consider physical and aesthetic needs of many parties, and design choices can even help with infection control. By Jeff Shaw Interior design for seniors housing is a tricky proposition. A room’s layout, lighting, colors and furniture must be both aesthetically pleasing and functional for a wide range of users. That list includes the residents, care staff and visiting family — all while still at a price and style that pleases the building’s owners. “There are a lot of cooks in this kitchen,” says Melissa Banko, principal …

Occupancy issues create underwriting headaches, slower approval process, but pipeline remains active. By Matt Valley The emerging consensus among lenders in HUD’s Section 232 mortgage insurance program for healthcare properties is that total deal volume in fiscal year (FY) 2021 will fall short of the nearly $4.4 billion in loan closings recorded the prior year. In fact, some lenders expect the total dollar amount of loans closed will decrease 10 to 20 percent on a year-over-year basis. Despite low interest rates, lenders cite an extremely challenging operating environment for …

Despite a pandemic-induced pullback in lending volume, the agencies remain committed for the long term to borrowers in need of debt financing. By Jeff Shaw Many parts of the seniors housing industry slowed as a result of the COVID-19 pandemic, including the lending market. Fannie Mae and Freddie Mac, the two giant government-sponsored enterprises (GSEs), experienced a significant pullback in deal volume in 2020, but remained two of the larger capital sources in the sector. “We are the predominant lender in the space,” says Steve Schmidt, national director of seniors …

Seniors housing lending isn’t dormant, but lenders and borrowers alike rethink their strategies as the pandemic continues. By Jeff Shaw The COVID-19 pandemic has been a shock to the entire seniors housing industry at every level, and capital providers in the sector are no exception. With occupancy at record lows, lenders and investors understandably have changed strategies to protect their investments. Occupancy continued its free-fall in first-quarter 2021, falling 870 basis points year-over-year to 78.8 percent for private-pay seniors housing, according to the National Investment Center for Seniors Housing & …

The largest developer of multifamily communities in the United States tries to bring fresh ideas to seniors housing. By Jeff Shaw While seniors housing carries more operational risk and complexity than other commercial real estate asset classes, the property sector is enticing investors because it offers comparatively higher capitalization rates, meaning a higher annual return on investment. In 2019 before the pandemic struck, the average cap rate for garden-style apartment communities was 5.6 percent compared with 6.4 percent for private-pay seniors housing, according to Real Capital Analytics. In 2019, Alliance …

By Matt Valley With mass vaccination efforts in the fight against COVID-19 well underway across the country and the economic clouds beginning to lift, the lending outlook for seniors housing has brightened considerably in recent months, say industry professionals. “If you are comparing today to pre-pandemic [market conditions], we think the lending environment is actually pretty good,” says Chuck Hastings vice president of finance and business development for Juniper Communities, an owner and/or operator of 25 seniors housing communities in New Jersey, Pennsylvania, Colorado and Texas. The portfolio’s total resident …

COVID-19 pandemic froze property sales in 2020, and experts say the big thaw likely won’t occur until occupancy improves. By Jeff Shaw U.S. seniors housing property and portfolio sales ground to a halt in 2020, with a total transaction volume of $9.9 billion, down 48 percent from $17.9 billion the prior year, according to Real Capital Analytics (RCA). The last time annual property sales for the sector were below $10 billion was in 2010, when the economy was still recovering from the Great Recession and total volume registered $6.2 billion. …

Sales teams are forced to rework the way they do everything in the light of pandemic lockdowns and restrictions. By Jeff Shaw When outbreaks of COVID-19 rocked the United States starting in early 2020, Americans were hit with a barrage of frightening news reports. Since the virus is much more likely to kill older adults, every day the news was filled with reports of mass deaths in seniors housing communities, particularly skilled nursing facilities. The disease has driven occupancy to a record-low rate of 80.7 percent for private-pay seniors housing …