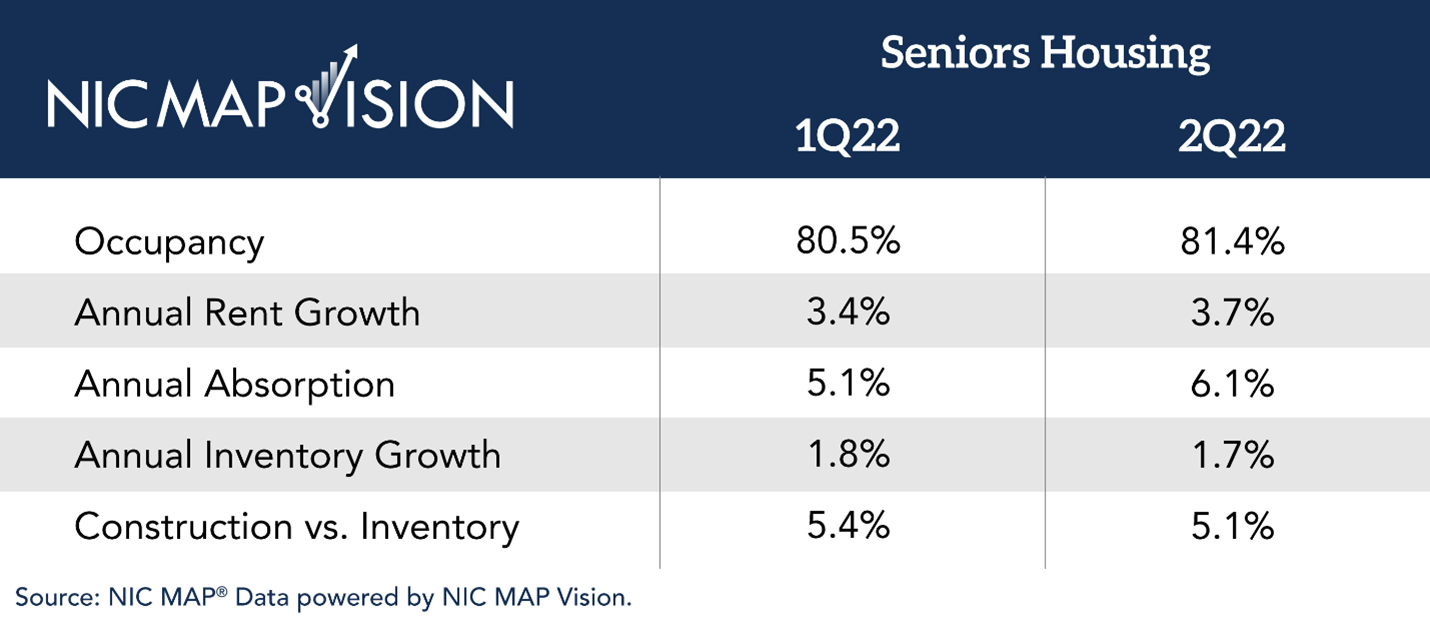

ANNAPOLIS, Md. — Private-pay seniors housing occupancy increased 90 basis points from 80.5 percent in the first quarter of 2022 to 81.4 percent in the second quarter of 2022. This is the fourth consecutive quarter of occupancy growth, and occupancy is up 340 basis points this quarter from a pandemic low of 78 percent in the second quarter of 2021. The pre-pandemic occupancy level was 87.4 percent.

That’s according to new data from the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit organization that tracks industry data gathered from 31 primary metropolitan markets through its NIC MAP Vision product. Private-pay seniors housing comprises independent living, assisted living and memory care.

Approximately 78 percent of the seniors housing units vacated during the pandemic have been reoccupied within NIC MAP’s primary markets.

“The sector has not fully recovered from occupancy losses during the height of the pandemic, but the continued upward occupancy trend despite workforce and supply challenges is a positive sign,” says Chuck Harry, NIC’s chief operating officer. “Today’s economic challenges could present another hurdle for operators, but we cautiously believe that the upward trend in occupancy will continue because the need for seniors housing remains strong.”

Demand continues to outweigh supply, driving occupancy upward. Quarterly demand was at its highest level since NIC MAP Vision began reporting the data in 2005. On the supply side, inventory increased by a lesser amount, 3,489 units, largely due to the pandemic-driven slowdown in construction starts in 2020. Starts were again weak in the second quarter of 2022, and units under construction measured the lowest since 2015.

“Rising materials prices, high inflation, construction industry labor shortages and the Federal Reserve’s policy change toward higher interest rates are collectively stalling new constructions,” says Beth Burnham Mace, NIC’s chief economist. “This will likely continue the trend of low to moderate levels of new inventory, which should help boost occupancy.”

Boston (86.3 percent), Minneapolis (85.1 percent) and Portland (85 percent) had the highest occupancy rates within NIC MAP’s primary markets in the second quarter of 2022. The markets with the lowest occupancy rates included Houston (76.1 percent), Atlanta (77.8 percent) and Cleveland (78.2 percent).

To view the full report, click here.