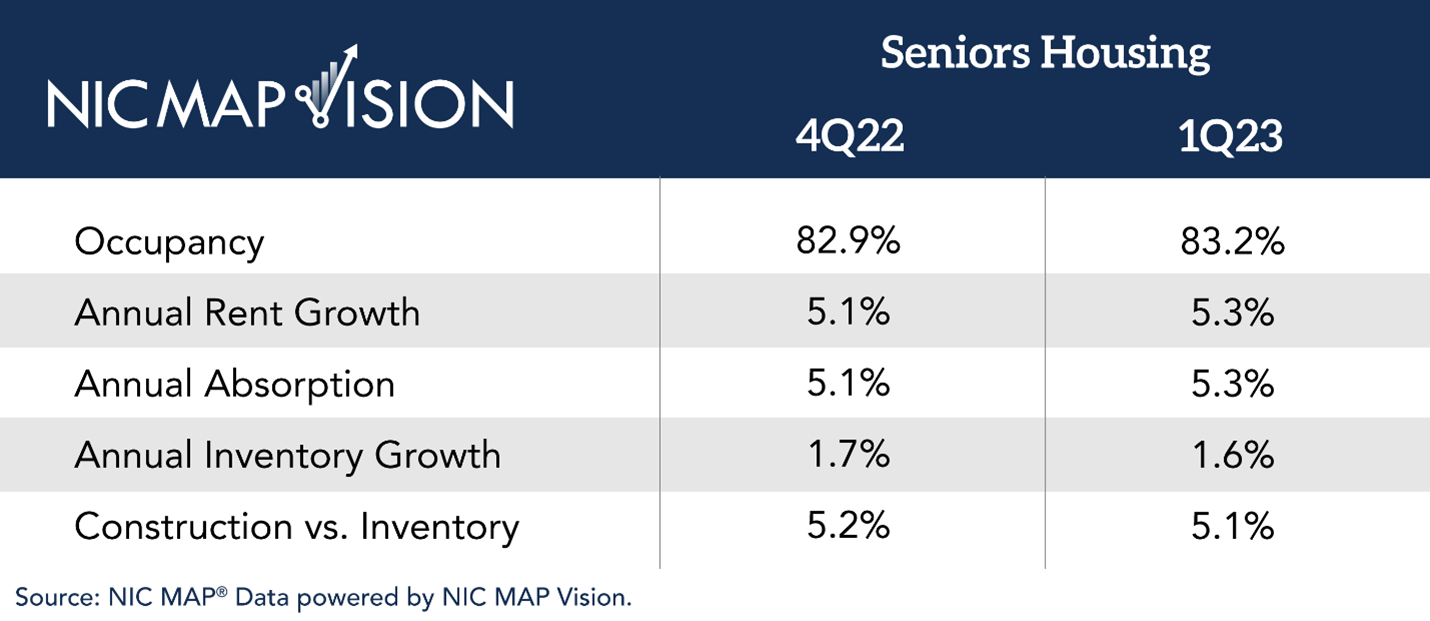

ANNAPOLIS, Md. — The private-pay seniors housing occupancy rate increased 30 basis points from 82.9 percent in the fourth quarter of 2022 to 83.2 percent in the first quarter of 2023, according to data from NIC MAP Vision released by the National Investment Center for Seniors Housing & Care (NIC).

NIC MAP Vision is a product of the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit firm that tracks industry data gathered from 31 primary metropolitan markets. Private-pay seniors housing comprises independent living, assisted living and memory care.

The occupancy rate has increased 540 basis points overall from a pandemic low of 77.8 percent in the second quarter of 2021 but remained 400 basis percentage points below the pre-pandemic high of 87.2 percent in the first quarter of 2020.

This represents the seventh consecutive quarterly occupancy rate increase, as a slowdown in inventory growth — 0.3 percent from the prior quarter and 1.6 percent year-over-year, near the lowest year-over-year increase in inventory growth since 2013 — is helping occupancy rates recover.

“The continued increase in seniors housing occupancy rates was driven by positive net absorption coupled with limited new supply,” says Chuck Harry, NIC’s chief operating officer. “The likely ongoing recovery in seniors housing fundamentals is further supported by the first quarter’s lowest rate of seniors housing construction since 2014. And construction is expected to remain suppressed during this period of significantly higher financing costs.”

Seniors housing units under construction relative to the total existing senior housing inventory continued to trend lower in the first quarter of 2023 to 5.1 percent, down 270 basis points from its historical peak of 7.8 percent in the fourth quarter of 2019. This is the lowest rate of construction since 2014 and is due largely to higher interest rates and a slowdown in financing.

“The increase in occupancy and rate growth should help to drive revenue growth, which may help seniors housing properties offset some of the increased expenses related to higher costs of debt, labor, food and energy that have affected the industry in recent years,” says Caroline Clapp, NIC’s senior principal, research and analytics. “The steady improvement in market fundamentals against a backdrop of significant volatility in other parts of the economy illustrates the needs-driven demand for housing and care for older adults that the industry continues to meet.”

The assisted living occupancy rate improved 70 basis points from the prior quarter to 81.2 percent, while independent living remained flat at 85.2 percent.

To see the full market report, click here.