By Matt Valley

A spike in interest rates coupled with operational challenges in the skilled nursing and seniors housing industries stemming from the COVID-19 pandemic took a toll on lending volume in HUD’s Section 232 mortgage insurance program in fiscal year (FY) 2022. Annual lending volume fell to $2.95 billion from $3.94 billion the prior year, a 25 percent drop. The number of transactions also decreased from 328 to 269, an 18 percent decline.

“The biggest surprise in 2022 was not that interest rates went up, but how drastically and quickly they went up. As a result, a lot of deals fell out,” says Scott Thurman, senior managing director and head of production for FHA healthcare at Greystone, the top producer in the HUD Section 232 program. The interest rates on long-term, non-recourse, fixed-rate financing jumped from slightly above 3 percent to 5.5 percent over a period of months, adds Thurman.

Jason Smeck, director of seniors housing and healthcare production at Lument, says the interest rate spike put a major crimp in the refinancing market. “The impact that COVID had on transaction volume in 2020 and 2021 had been partially offset and masked by the low interest rate environment of 2020 and 2021, which caused a rush to refinance existing FHA-insured loans in the portfolio at the lower rates available at that time. However, now that interest rates have risen, that volume has dried up.”

Smeck expects deal volume to remain “muted” in FY 2023, even with the pandemic largely in the rearview mirror.

“While census has picked up in communities, NIC data indicates that we are well below pre-pandemic occupancy levels. Factor in the staffing challenges that properties face nationwide that drive higher payroll costs, the higher food and supply costs, and the higher interest rate environment — which impacts debt-service coverage ratios — and you will see that we continue to face many headwinds in our industry,” says Smeck.

Nursing care occupancy was 79.3 percent in third-quarter 2022, up from its pandemic low of 74 percent in the first quarter of 2021, but still below its pre-pandemic level of 86.6 percent, according to NIC MAP Vision.

Inside the numbers

Michael Gehl, chief investment officer of FHA lending at NewPoint Real Estate Capital, says a breakdown of the data shows that 223(a)(7) loan volume fell by $798.8 million, or 43 percent, on a year-over-year basis, while the 223(f) loan volume dipped by $219 million, or 11 percent. However, each program’s loan totals declined for different reasons.

The 223(a)(7) program is utilized to refinance an existing HUD loan. The intent is to lower a project’s debt service through a combination of a lower interest rate and an extension of the loan amortization. The result is an improved debt-service coverage ratio and a better loan for the HUD 232 program, explains Gehl.

At the start of HUD’s FY 2022, the 10-year Treasury yield stood at 1.48 percent. By the end of FY 2022, the 10-year yield had climbed to 3.83 percent due to inflation and a series of rate hikes by the Federal Reserve. (HUD’s fiscal year runs from Oct. 1 to Sept. 30.)

“As the year progressed, many deals that were looking to refinance and lower their interest rate just did not work anymore. In fact, of the $1.04 billion in 223(a)(7) loans closed in HUD’s 2022 fiscal year, 82 percent closed in the first half of the year, demonstrating just how much the rise in interest rates impacted volume in the back half of the year,” points out Gehl.

The decline in 223(f) loan volume in FY 2022 had more to do with the underlying fundamentals in the nursing home industry, he adds.

Individual company highlights

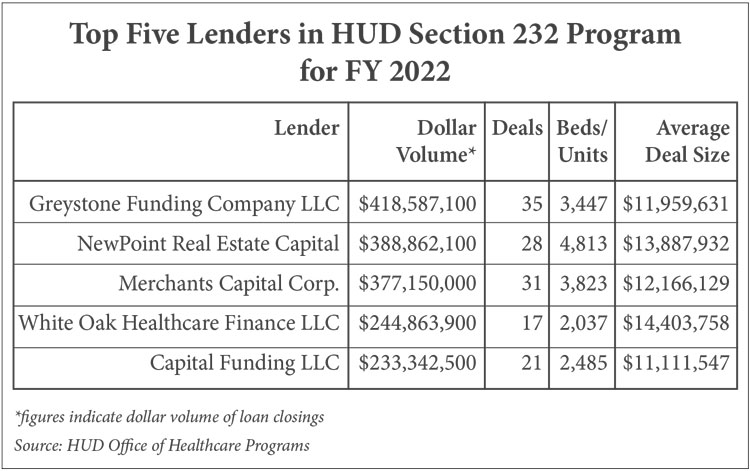

Greystone was the top producer in the HUD Section 232 program for the third straight year with $418.58 million in loan volume and 35 total transactions. However, those figures pale in comparison to Greystone’s deal volume in FY 2021 when the lender completed 71 transactions for a total deal volume of $888.8 million.

“We’ve got a positive attitude for 2023 of what can get done. We know the environment that we’re in, and people are adjusting to it. We’re looking at doing the same volume of lending in fiscal year 2023 that we had in fiscal year 2022. We don’t see it falling off,” says Thurman.

The skilled nursing segment accounted for 80 to 85 percent of Greystone’s lending activity in the HUD Section 232 program in FY 2022, says Thurman. That’s not surprising because HUD competes aggressively in the skilled nursing arena and its loan products offer very favorable terms for borrowers. Still, part of Thurman’s business strategy is to grow the assisted living and memory care portion of Greystone’s HUD lending portfolio.

Lument closed 13 transactions totaling $164 million in FY 2022. “While those figures are down in comparison to our historical volume, it’s a reflection of the challenging post-pandemic environment,” says Smeck. Lument closed 23 transactions totaling $220.7 million in FY 2021.

“While I believe we will continue to see overall HUD volume in fiscal year 2023 among all lenders be light relative to pre-pandemic levels, we are hopeful that some normalcy comes to the forefront in fiscal year 2024,” says Smeck.

NewPoint Real Estate Capital, which acquired Housing & Healthcare Finance in December 2021, closed 28 deals for $388.8 million in FY 2022 compared with $552.8 million in FY 2021. Given the headwinds in the debt financing market, Gehl expects deal volume this year to be more in line with FY 2022 versus FY 2021.

Should borrowers rethink their strategies?

Lenders and borrowers never like to see such a rapid rise in the cost of debt, emphasizes Gehl. “That said, when you look at an 11 to 13 percent cap rate for an asset like skilled nursing, the debt-service coverage is still ample for borrowers, even with the run-up in interest rates.”

The HUD Section 232 program has always provided a way for borrowers to put their capital structure to bed for a long period of time and focus on operations, and that has not changed, says Gehl.

“My advice to borrowers is to move quickly to start the HUD process, as it takes six to eight months to close a transaction. A lot can happen in that time. If your goal is to put permanent capital into place, don’t procrastinate.”

Smeck says that many borrowers are questioning whether now is a good time to move forward with a loan application and lock in an interest rate at the current level.

To those borrowers on the fence, Smeck points to the stability generated by the FHA 223(f) mortgage insurance program, the length of the loan term (a maximum of 35 years not available in any other program), and the ability to refinance the loan at a lower rate in the future through the 223(a)(7) program for existing FHA-insured loans.

“If a borrower is convinced that interest rates will come down to more palatable levels in the years to come, then structuring a more flexible prepayment structure is a good consideration, and our bankers can help them understand their options.” n