With operating fundamentals on the rise and demographics on their side, this growing group of investors in seniors housing believes the stars are aligned to achieve healthy returns.

By Jane Adler

While some longstanding private equity groups in seniors housing remain on the sidelines as they work through the operational challenges created by the COVID-19 pandemic, others are making investments in the sector. Fund managers are raising capital and seeking investment opportunities. New private equity players are emerging. And more private equity groups are entering into joint ventures and forging strategic alliances with growth-minded operators.

The timing is right to acquire senior living properties, sources say. Property values are still depressed from the fallout of the pandemic. Supply and demand fundamentals are mismatched. Few new projects are being built, while the long-awaited demand from baby boomers is finally becoming a reality.

Asset managers want exposure to seniors housing because of the healthy operating fundamentals. The performance of seniors housing compares favorably to other commercial real estate asset classes. The 10-year annualized total return for seniors housing (7.92 percent) was the strongest of the main property types, except for industrial (14.2 percent), according to fourth-quarter 2023 data compiled by the National Council of Real Estate Investment Fiduciaries.

“The next 10 years will be some of the best years of the sector on record,” predicts David Selznick, chief investment officer of real estate for Kayne Anderson, an alternative investment management fund. “We really like the sector.”

Others agree.

Livingston Street Capital has the bulk of its portfolio in active adult and independent living projects. The firm has $900 million in assets under management. “We’re looking for opportunistic investments,” says Peter Scola, CEO at Livingston, headquartered in Pennsylvania.

Last year, Livingston closed on Mountain Lakes Estates, a 131-unit independent living community in Reno, Nevada, built in 2020. The company will soon close on its fourth independent living property and has identified a fifth property that it hopes to acquire.

Livingston doesn’t invest in care-based models, such as assisted living or skilled nursing. The positive performance of active adult and independent living projects during the pandemic has drawn investors, says Scola. “Capital is there for the right deal.”

Investors are drawn to active adult projects because the average annual resident turnover is 20 percent versus 50 percent for traditional multifamily properties, while not as operationally complex as traditional seniors housing.

Properties in Livingston’s portfolio have occupancies of around 90 percent. “We are focused on asset management,” says Scola. The company has its own captive property management arm, Allure Lifestyle Communities.

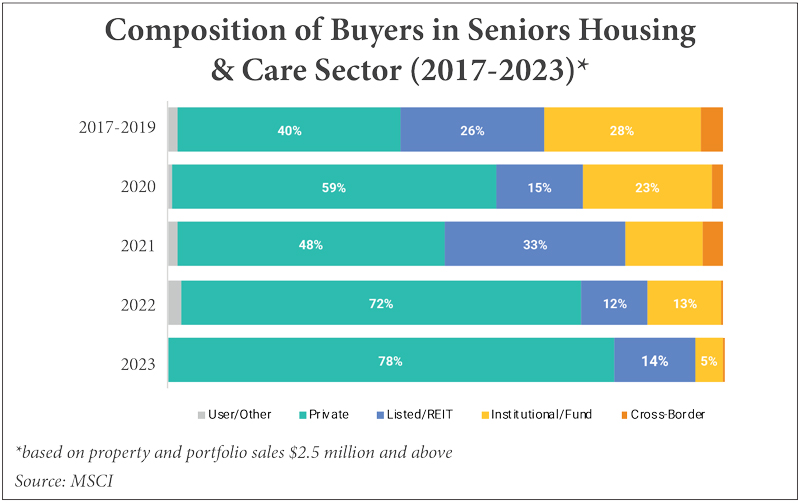

Meanwhile, private equity firms have become more active investors over the past 12 months (see sidebar, page 20). “The composition of private equity funds investing in the space has changed more in the last 12 to 18 months than it has in the last 20 years,” says Aron Will, vice chairman at CBRE’s Houston office.

Will divides private equity investors into three categories. Some had large seniors housing portfolios when COVID hit and are still working through those challenges. “Some are becoming more active,” says Will. “Others are not.”

The second type of private equity firm is composed of investors that exited the sector pre-COVID and now believe the time is right to invest in the space again due to the dramatically improved operating fundamentals with very little supply on the horizon.

The third category is completely new to seniors housing and interested in the sector for thematically the same reasons — the improved operational picture and the first wave of baby boomers turning age 80 in 2026.

Returning funds and new entrants represent about 70 percent of the private equity transactions, says Will. They’re seeking and acquiring high-quality assets at below replacement cost. Offerings include debt, mezzanine loans and preferred equity with expected returns in the low to high teens. “There are lots of ways to invest in the capital stack to generate good returns,” says Will.

CBRE recently arranged the sale of Arbor Terrace Peachtree City, a 146-unit independent living and assisted living community in Peachtree City, a suburb south of Atlanta. It was purchased by Chicago-based Gem Realty Capital, a newer private equity entrant to seniors housing with about $9 billion of assets under management. The property is an example of a stable asset with strong upside potential, according to Will.

Value-add opportunity knocks

Well-positioned, newer buildings in growth markets are attracting more bidders, including private equity firms, according to Rick Swartz, seniors housing group leader at JLL Capital Markets in Boston. “More competitive bidding has put some upward pressure on pricing.”

Pricing is being driven more by in-place revenues rather than projected revenues. “Investors are being conservative,” says Swartz. But some private equity firms are making all-cash purchases. For example, a desirable building may be only 60 percent occupied and unable to support new debt. But it might sell at a price significantly below replacement cost. “Private equity shops will buy the property, solidify performance and put debt on it at a later date,” he says.

Recognizing the dislocations in both the seniors housing and capital markets, a number of funds are seeking these value-add investment opportunities. Properties are acquired at a low-cost basis. Some highly leveraged owners face loan maturities and need to sell, putting downward pressure on property values. After purchase, the properties can be repositioned with minor operational improvements to boost occupancy as the 85-plus age cohort grows.

Birchwood Healthcare Partners, based in Chicago, is focused on “light” value-add properties or stable seniors housing built in the last five to 10 years. Birchwood’s 5V+ Seniors Healthcare Fund completed its first round of fundraising in 2023. Capital is currently being raised for a second closing.

The company recently made two new investments: a transitional care community and a new seniors housing development. “We hadn’t purchased anything since 2020,” wrote Isaac Dole, in an email. He is founder and CEO at Birchwood and former managing director of acquisitions at Aviv REIT. “We saw this window opening up where we wanted to grow,” he adds.

Private equity firms typically sell a property for a profit after a hold period of about five to seven years. “We think that needs to change,” says Susan Barlow, co-founder and managing partner at Boston-based Blue Moon Capital Partners.

“Our industry needs more private long-term hold vehicles to help restructure the industry after the disruptions of the pandemic and capital markets,” she adds. While there is a place for shorter-term investments, Barlow says investors with a longer time horizon will help bridge the industry to the coming wave of baby boomers.

Blue Moon invests in seniors housing on behalf of institutions such as large public pension funds. “It’s a great fit for the sector,” says Barlow. “They are managing money for retirees.”

The firm is currently in a quiet period as it raises capital for a new fund, so Barlow declined to comment on the specifics of the Blue Moon portfolio. But she says in general the firm isn’t interested in the active adult segment.

Instead, Blue Moon plans to stay on the seniors housing side, which includes care. She says that the lessons learned from the pandemic have improved operations and that will benefit investors. “That’s where we can make a difference.”

Targeting growth

Meanwhile, some private equity firms are tackling renovations and repositionings. Last year, Focus Healthcare Partners acquired Lexington Square Senior Living in Elmhurst, Illinois. The community is being rebranded as The Roosevelt at Salt Creek. It is also being converted from an entry-fee to rental model, offering independent and assisted living.

Life Care Services of Des Moines will manage the property. A multimillion-dollar renovation will

feature enhanced amenities, including an indoor pool, cinema, art studio and sports lounge.

Chicago-based Focus declined to comment on the project. The firm is in a quiet period as it wraps up fundraising for a new investment vehicle expected to close in May.

Active private equity firms are also gravitating toward well-located, newer projects in growing markets.

In late 2023, Artemis Real Estate Partners purchased Franklin Park Alamo Heights, a 221-unit community in San Antonio. Artemis took over as equity partner from Harrison Street, a private equity firm based in Chicago. The recapitalization, including a Freddie Mac loan, was arranged by JLL. The price and amount of financing were not disclosed.

Franklin Park Alamo Heights is a luxury property. It features large units and upscale amenities including an indoor pool, fitness center, theater, game room and library.

San Antonio was the fastest growing big city in the nation during the pandemic, according to the U.S. Census Bureau.

In a press release, Kelly Sheehy, senior managing director at Artemis says, “The acquisition is consistent with our strategy of purchasing high-quality seniors housing assets in markets with strong demographics in partnership with experienced local operators.”

Getting creative

Private equity firms are making strategic use of joint venture operating partners. In 2023, Lee Equity Partners and Coastwood Senior Housing Partners recapitalized Discovery Senior Living to help fuel its growth. Discovery is based in Bonita Springs, Florida.

Lee and Coastwood also invested in Carslbad, California-based Integral Senior Living, which is partnering with Discovery to share best practices. Combined, the operators manage 27,000 senior living units.

In February 2024, Artemis partnered with Scarp Ridge Capital Partners, a private investment firm headquartered in New York City, and operator Arrow Senior Living to purchase three seniors housing communities in the St. Louis and Kansas City metropolitan areas. JLL arranged the sale. The communities are located in Wildwood, Missouri; Town & Country, Missouri; and the Burlington Creek area of Kansas City, Missouri.

The three buildings include a combined 252 units and offer upscale amenities. They were built between 2016 and 2018, fitting the investment criteria of Class A assets in strong submarkets with residential growth.

Operating partners are key to success, sources say. Harrison Street has been tactically pruning less strategic assets over the past several years, but it looks for operators with a “people-first” mentality, according to Mike Gordon, partner and global chief investment officer at Harrison Street.

Happy employees help to produce satisfied residents and family members, leading to net operating income growth and margin expansion, explains Gordon. “It’s the caregivers that form bonds with the residents, and when residents and their families are happy, communities tend to stay full.”

Looking ahead, Gordon expects to see a relatively swift return of liquidity to the sector within the next 12 to 24 months, with private equity a major player along with other types of investors.

Expect more interest from institutions. Blue Moon’s Barlow points to a February 2024 article in Institutional Real Estate Americas, a monthly publication read by managers of pension plans and foundations, as well as consultants. The article was titled, “The Challenges and Opportunities in Senior Housing.”

“That’s a big deal,” she says. It was the first time that seniors housing had been profiled that way in the journal. The article noted the healthy returns of the industry over a 10-year period and the societal impact of the product to house frail seniors.

“We will get more attention from institutional investors,” says Barlow, “and that is good.”