PHILADELPHIA — Berkadia has secured a $13.6 million Low-Income Housing Tax Credit (LIHTC) equity investment for the development of Clearfield Apartments, a 48-unit affordable seniors housing community in Philadelphia’s Allegheny West neighborhood. Chris McGraw, senior vice president based in Berkadia’s Charlotte, N.C. office, secured the equity investment on behalf of the sponsor, NewCourtland. When completed, Clearfield Apartments will consist of 48 one-bedroom units in one four-story, elevator-serviced building serving seniors age 62 and above. All 48 units will operate under a project-based rental subsidy through the Faircloth-to-Rental Assistance Demonstration (RAD) program. …

Finance

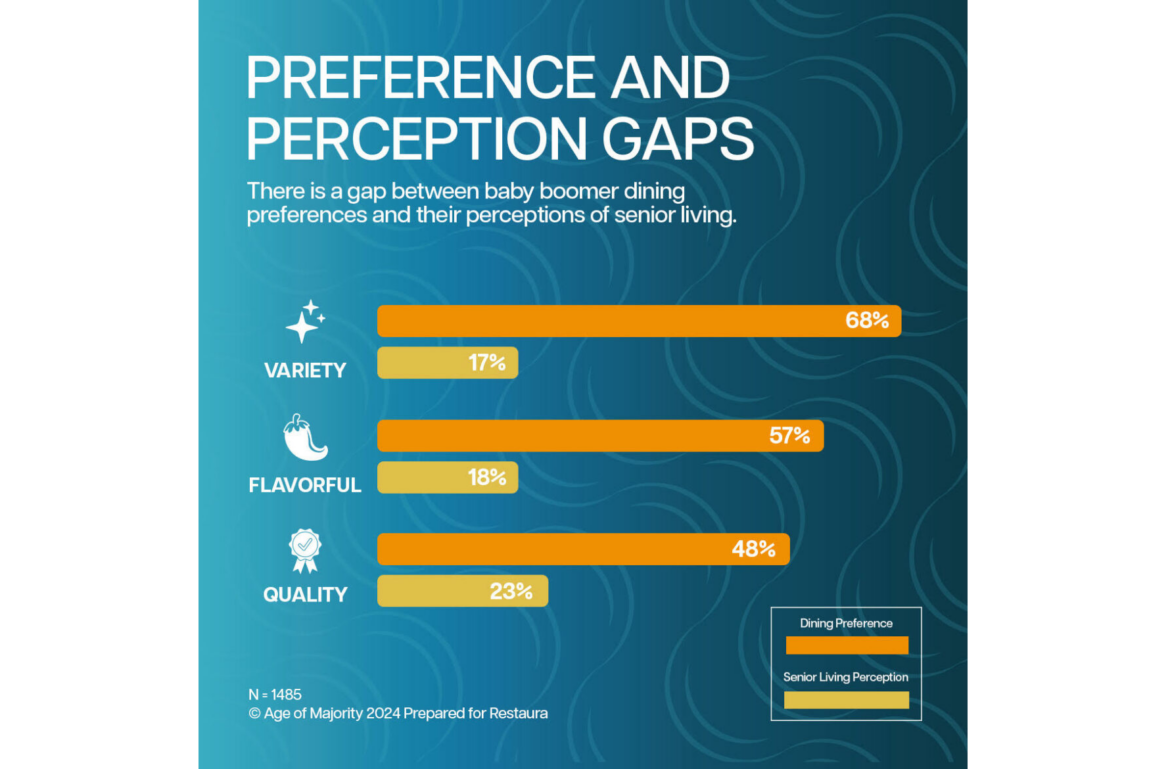

BOSTON — Older adults aspire to be “ageless wonders” and prioritize food and nutrition as the No. 1 factor affecting their health and well-being, according to a newly released survey. The majority of today’s baby boomer population (69 percent) plan to age in place, the “Great Expectations” survey conducted by Age of Majority for Restaura found. A key factor in their desire to stay in their homes could be the significant gap the survey uncovered between how and what they like to eat and the perceived ability of senior living communities …

MONTVALE, N.J. — Mesa West Capital has provided a joint venture entity with a $57 million loan to refinance Thrive at Montvale, a 203-unit seniors housing community in Montvale, an affluent New York City suburb located 30 miles north of the city. The joint venture is comprised of AEW Capital Management, Thrive Senior Living and Pike Construction. The five-year, floating-rate loan is secured by the 11.5-acre community built in 2022 by Thrive, an Atlanta-based senior living development and investment firm, and Pike, a New Jersey-based developer and general contractor. Thrive at Montvale is …

By Charlie Shoop In recent years, our economy has weathered rising interest rates and labor shortages, proving to be tough challenges for the seniors housing sector. Despite these hurdles, two-thirds of seniors housing owners, operators and other professionals responded optimistically to a survey about the current direction of the industry. KeyBank Real Estate Capital surveyed a group of seniors housing owners, operators, investors, investment bankers, lenders and brokers in late 2023 to understand their perspectives on the current state of their businesses and the industry at large. Respondents were most …

ST. PETERSBURG, Fla — Ziegler has arranged $29.4 million in bond financing for Convivial St. Petersburg LLC, which plans to develop a continuing care retirement community (CCRC) on a 5.2-acre site in St. Petersburg. The Series 2024 Revenue Bond Anticipation Notes are comprised of $23.4 million of tax-exempt Series 2024A Notes sold publicly to institutional investors, and $6 million of subordinate tax-exempt and taxable notes purchased by an affiliate of the developer and manager of the project. The borrower will use the proceeds of the revenue bond anticipation notes to fund …

CHICAGO — MonticelloAM and its affiliates have provided $59.2 million in bridge and working capital financing for a portfolio of skilled nursing facilities in metro Chicago. Proceeds from the $52.2 million bridge loan were used for the acquisition of three skilled nursing facilities. The $7 million working capital revolver will be used to support the day-to-day operations across the properties, covering over 700 licensed beds. Karina Davydov, a managing director at MonticelloAM, originated the loan that carries a two-year term with two six-month extensions. “MonticelloAM understands the challenges borrowers are facing …

TAYLOR, Mich. — Bayview PACE has provided $4.3 million in commercial property-assessed clean energy (C-PACE) financing for the 81-unit Hampton Manor of Taylor seniors housing community, located about 17 miles southwest of Detroit. The sponsor was Build Senior Living, the development arm of Hampton Manor Assisted Living. The 81-unit Hampton Manor of Taylor is situated on a six-acre landscaped site that includes 60 parking spaces. Licensed for 102 beds, Hampton Manor-Taylor features 65 assisted living units and 16 memory-care units with extra capacity for second persons and/or additional companion units. …

ATLANTA — Investment markets have been tumultuous over the past year, with high interest rates and inflation impacting the flow of debt and equity across the commercial real estate industry. Last year, many investors and brokers chose to weather the storm and try to make it to 2025, when it was estimated that interest rates would begin to moderate. Recently, however, conditions seem to be improving in the seniors housing sector, where many investors are leaving behind the “survive till 2025” strategy that defined 2023. Editor’s note: InterFace Conference Group, a …

MALVERN, Pa., and KENSINGTON, Md. — Mesa West Capital has provided AEW Capital Management LP with $114.6 million in first-mortgage debt across two loans to refinance the seniors housing communities of Echo Lake in Malvern and Modena Reserve at Kensington in Kensington. Terms of the loans were not disclosed. AEW delivered the 250-unit Echo Lake to the market in 2020 alongside joint venture partner Sage Senior Living Inc., which operates the community. Located about 27 miles northwest of Philadelphia in Malvern, Echo Lake offers a mix of independent and assisted …

SARASOTA, FLA. — Aztec Group has arranged a $54.5 million bridge loan for Alloro at University Groves, a seniors housing community located in Sarasota. An affiliate of United Group of Cos. was the borrower. Mortgage REIT provided the debt. Developed in 2023, Alloro at University Groves features 183 units for residents aged 55 and older. Amenities at the community include a 12,587-square-foot clubhouse, fitness center, yoga room, salon, movie theater, pickleball and bocce courts, a spa, community garden, dog park and onsite dining facilities.

![Thrive at Montvale[50] Thrive at Montvale in Montvale, New Jersey](https://seniorshousingbusiness.com/wp-content/uploads/2024/10/Thrive-at-Montvale50-1170x789.jpg)