SEATTLE — CBRE National Senior Housing has arranged a $23.3 million refinancing for Queen Anne Manor, a 93-unit assisted living and memory care community in Seattle. Aron Will, Adam Mincberg and Michael Cregan of CBRE National Senior Housing arranged the 10-year bridge loan with three years of interest-only payments through a national bank. The borrower is Capitol Seniors Housing. Originally built in 1908 as Seattle’s Children’s Orthopedic Hospital, the community was converted to seniors housing in 1982. Extensively renovated in 2015, the community is located two miles from downtown Seattle …

Finance

Financing vehicle enables private equity firms to open another revenue line while offering borrowers an option when lenders are scarce. By Jeff Shaw The growing popularity of private equity-backed debt funds is a win-win for many of the players involved. Rather than use their capital to buy more properties, private equity investors can lend money as a lower-risk, fixed-income alternative to owning assets. Borrowers have another source of debt, especially at a time when lenders may be scarce. Just as banks, for example, were re-entering the seniors housing fray following …

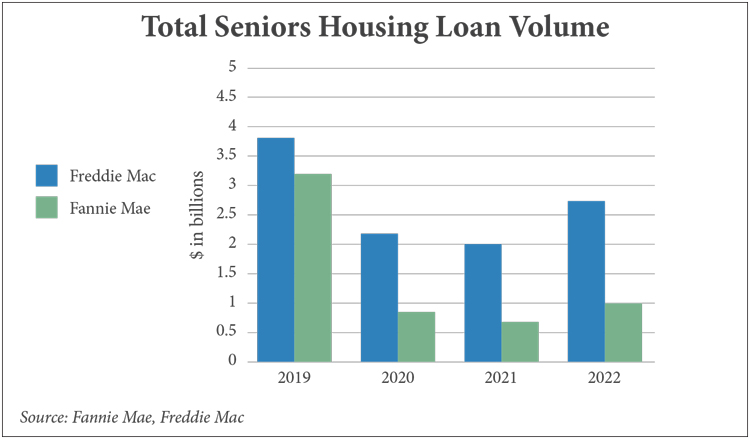

While financing sources appeared to return to form in early 2022, volatility in the capital markets ultimately throttled down deal volume in the second half of the year. By Jeff Shaw At first glance, 2022 looks like a partial return to pre-pandemic form for Fannie Mae and Freddie Mac’s deal volume within the seniors housing sector. After major downturns in 2020 and 2021, Fannie Mae’s volume rose 26 percent from $800 million in 2021 to $1 billion in 2022. Freddie Mac’s volume rose 29 percent from $2.1 billion to $2.7 …

By Matt Valley March is notoriously volatile weather-wise, but March 2023 will long be remembered as a particularly stormy month for the financial markets. The collapse of two banks over a 48-hour period early in the month hit like a bolt of lightning. Santa Clara, California-based Silicon Valley Bank, a lender to technology startups, failed following a bank run during which depositors and investors withdrew $42 billion on March 9 alone. On March 10, the bank was placed under the receivership of the Federal Deposit Insurance Corp. (FDIC). Two days …

Despite a turbulent economy, many lenders have continued to put money into seniors housing as the industry’s demographics and metrics improve. Roundtable participants Michael Gehl Chief Investment Officer, FHA Lending NewPoint Real Estate Capital Scott Blount Senior Managing Director VIUM Capital Bill Lewittes Managing Director, Head of Loan Originations Kayne Anderson Real Estate Michael Coiley Managing Director CIT Healthcare Finance Ryan Stoll National Director of Seniors Housing and Care Bellwether Enterprise Real Estate Capital Ari Adlerstein Senior Managing Director, Co-Head of Seniors Housing Meridian Capital Group Lawrence Brin Managing Director, …

NEW YORK CITY — Berkadia Seniors Housing & Healthcare, in partnership with Live Oak Bank, has arranged four bridge-to-HUD loan closings totaling $86 million in the first quarter of 2023. The partnership between Live Oak Bank and Berkadia, which commenced in October 2022, has closed $143 million of bridge-to-HUD and GSE transactions, the majority of which have been structured as A/B notes with Berkadia funding the B-note. The interest-only loans typically carry terms of 24 months with rates floating over one-month term SOFR. Loans closed to date facilitated purchases and …

ALABAMA — Capital Funding Group (CFG) has provided $84.7 million in bridge-to-HUD financing for the acquisition of seven skilled nursing facilities and one assisted living community in Alabama. The borrower is Venza Care. The portfolio totals 797 beds. Capital Funding Group’s Craig Casagrande and Andrew Jones originated the transaction.

CALIFORNIA — Capital Funding Group (CFG) has provided $10.9 million in financing, which supported the refinancing of an existing bridge loan, executed by CFG, into a HUD loan. The refinancing is for a 99-bed skilled nursing facility in California. Further details were not disclosed. Capital Funding Group’s Tim Eberhardt and Ava Julio originated the transaction for the company.

CHICAGO — MidCap Financial has provided a floating-rate refinancing for a Class A, 240-unit independent living community in the North Shore suburbs of Chicago. The borrowers are affiliates of Harrison Street and Banner Real Estate Group. The subject property has steadily leased up since opening in 2020 and benefits from its affiliation with CJE SeniorLife and physical quality, according to MidCap. Sarah Anderson of Newmark arranged the transaction.

By Taylor Mokris and Kim Huffstutler In this market, with the twin difficulties of persistent inflation and interest rate hikes, it can be a challenge to find the right real estate investment. However, as lenders work with developers, owners and operators to make deals and find quality investments, there’s one real estate sector no savvy investor should overlook: seniors housing. Now is an opportune time for new and repeat lenders alike to have conviction around their commitment to this asset class. Not only does seniors housing have strong underlying fundamentals …