CHICAGO — Senior Living Investment Brokerage (SLIB) has arranged the sale of three skilled nursing properties in metro Chicago totaling 491 beds. The communities are the premier nursing homes in the area and include CMS 5-Star ratings and JCAHO accreditation, according to SLIB. The seller was a privately owned, family-run company that was looking to exit the skilled nursing space. After COVID and the evolution of the industry it became clear to the seller that this portfolio would thrive better with a new owner that had more communities with more …

Skilled Nursing

Ensign Group Takes on Operations of Two Skilled Nursing Facilities in Nevada, Tennessee

SPARKS, Nev., and HARROGATE, Tenn. — The Ensign Group Inc. (Nasdaq: ENSG) has acquired the operations of Hearthstone Health and Rehabilitation, a 125-bed skilled nursing facility located in Sparks, and TriState Health and Rehabilitation Center, a 116-bed skilled nursing facility located in Harrogate. Ensign will operate both properties under an long-term, triple-net lease. These acquisitions bring Ensign’s growing portfolio to 299 healthcare operations, 27 of which also include senior living operations, across 14 states. Ensign subsidiaries, including Standard Bearer, own 113 real estate assets.

G Capital Markets Arranges Refinancing for 65-Bed Community Facility in Plum City, Wisconsin

PLUM CITY, Wis. — G Capital Markets has arranged the permanent refinancing of a skilled nursing and assisted living facility in Plum City, a tiny village of fewer than 1,000 residents approximately 60 miles southeast of the Twin Cities. The property was originally built in 1987 and renovated in 2005, with an assisted living expansion built in 2014. The community features 65 beds in 41 private and semi-private units, with a ratio of 70 percent skilled nursing to 30 percent assisted living. The community has performed strongly with occupancy consistently …

ILLINOIS and MISSOURI — Evans Senior Investments (ESI) has secured a tenant and executed a 10-year lease agreement for a large skilled nursing and supportive living portfolio spanning across Illinois and Missouri. The portfolio comprises 13 communities located totaling over 1,600 licensed beds. The lease consisted of a ten-year term with a purchase option. Evans Senior Investments selected a regional Midwest group as the tenant. Neither the tenant nor landlord were disclosed.

WARRENTON, EASTMAN, GLEN EAGLE and SPARTA, Ga. — Selectis Health Inc. (OTC: GBCS) has agreed to sell the company’s four owned and operated skilled nursing facilities in Georgia. The agreements provide for the sale of the Company’s Warrenton Healthcare & Rehabilitation, Eastman Healthcare & Rehabilitation, Glen Eagle Nursing and Rehabilitation and Providence of Sparta Healthcare & Rehabilitation facilities, for an aggregate consideration of $31 million. All four properties are located in rural markets in Middle Georgia. The Warrenton property features 110 beds, the Eastman 100 beds, Glen Eagle 101 beds …

Ziegler Negotiates $35.6M Sale of Eskaton Skilled Nursing Portfolio in Metro Sacramento

SACRAMENTO, FAIR OAKS and CARMICHAEL, Calif. — Ziegler has acted as exclusive financial advisor to Eskaton Properties Inc. on the sale of a skilled nursing portfolio in the greater Sacramento area. The 391-bed portfolio consists of Eskaton Care Center Fair Oaks, Eskaton Care Center Greenhaven and Eskaton Care Center Manzanita. The communities are in proximity to each other. Fair Oaks was built in 1983 and has 148 beds on a three-acre lot in Fair Oaks. Greenhaven was built in 1978 and has 148 beds on a 4.92-acre lot in Sacramento. …

KENTUCKY — Capital Funding Group (CFG) has provided a $7.2 million HUD-insured loan to refinance debt on a 162-bed skilled nursing facility in Kentucky. CFG executed the original bridge loan, which allowed the borrower to acquire the facility’s real estate; the facility has since stabilized and is now exiting with permanent HUD financing. Further details on the property and borrower were not disclosed. Patrick McGovern originated the transaction for the CFG.

Blueprint Negotiates Sale of 53-Bed Skilled Nursing Facility in Boston for Apartment Conversion

BOSTON — Blueprint Healthcare Real Estate Advisors has brokered the sale of a 53-bed skilled nursing facility in Boston. The asset was originally constructed in 1960 and located just south of downtown. The building was well maintained, according to Blueprint, and spans over 18,000 square feet and a variety of unit configurations, along with close proximity to several large mixed-used developments and regional hospitals. The buyer was a family office that intends to convert the property into multifamily apartments. Details on the seller and price were not disclosed. Kyle Hallion …

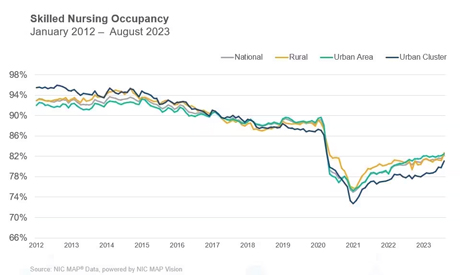

ANNAPOLIS, Md. — Skilled nursing occupancy nationwide increased 59 basis points from July to August, reaching 82.3 percent at the end of the month. That’s according to a blog post this week by Bill Kauffman, senior principal with the National Investment Center for Seniors Housing & Care (NIC). The Annapolis-based organization is the main source of data tracking for the seniors housing industry. The new skilled nursing occupancy number is an increase of 142 basis points from the pandemic low of 75 percent in January 2021. Occupancy hovered around 81 …

ARIZONA — Capital Funding Group (CFG) has provided a $10.9 million HUD loan, which refinances an existing bridge loan on a 112-bed skilled nursing facility in Arizona. CFG originally arranged the bridge loan as well. Tommy Dillon originated the transaction for CFG. No further details were provided.