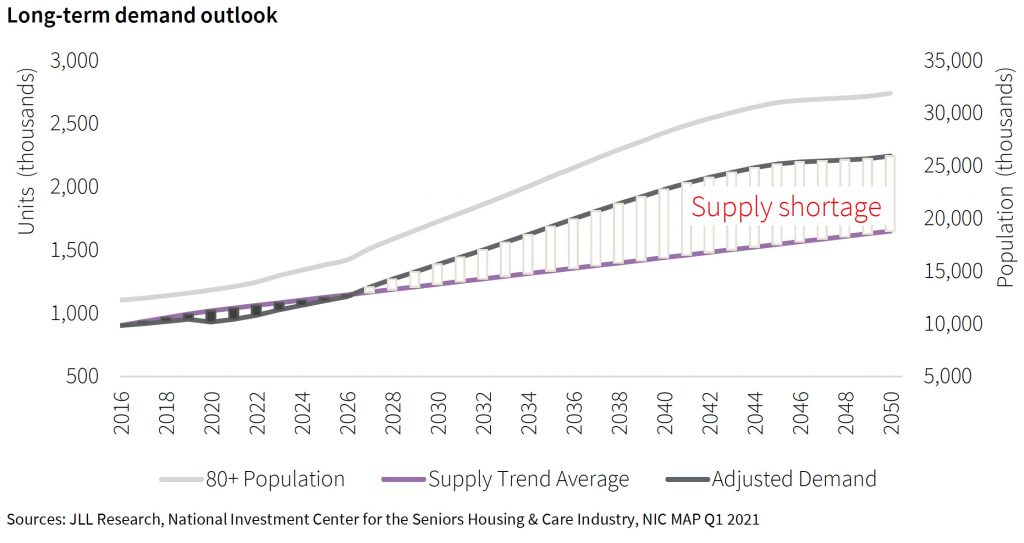

Based on estimated population and seniors housing units available, JLL predicts a supply shortage starting around 2026 and worsening in the following years. Click to view larger.

CHICAGO — Although the seniors housing industry still faces many challenges, long-term demand still has the sector on a trajectory of growth.

That’s according to JLL Valuation Advisory’s fourth annual Seniors Housing Investor Survey and Outlook, released last week.

Construction delays resulting from the pandemic will magnify the long-term supply shortage, the report notes. With the baby boomers within approximately 10 years of occupancy, medium- and long-term investment remains positive. Additionally, the need to serve the middle-income population will continue to grow, exacerbated by the global impact of COVID-19.

“Investors remain bullish on seniors housing and care investments,” says Zach Bowyer, head of alternatives asset sectors. “We anticipate market fundamentals to steadily improve and the market to re-stabilize between two and four years, depending on the location.”

Investors appear to agree. Despite seniors housing and care transaction volume falling 48 percent year-over-year to $9.2 billion in 2020, 53 percent of respondents reported they plan to increase their exposure to the sector in 2021.

The survey also revealed that, after a trend toward more lifestyle-focused segments of seniors housing, participants are moving to more traditional and need-driven segments, with 37 percent of respondents identifying assisted living as the most sought-after investment opportunity in 2021.

Additionally, despite the disruption, available capital for commercial real estate investment remains near all-time highs, with the seniors housing and care sector noticing a significant increase in the percentage of private capital placement.

“Dry powder for commercial real estate investments are at an all-time high,” says Bryan Lockard, co-lead for the seniors housing practice at JLL. “Investors are being cautiously selective, as short-term and long-term uncertainty remains for most sectors, with confidence increasing from a successful vaccine rollout within seniors housing communities and declining infection rates.”

Seniors housing valuations dropped to an eight-year low, with an average price per unit of $141,800 reported for 2020, down 16 percent year-over-year. The average capitalization rates for seniors housing transactions increased year-over-year by 50 basis points to 6.5 percent after reaching an all-time low of 5.9 percent in 2019. Additionally, after four consecutive years of declines, the average price per bed for nursing homes increased by nearly 20 percent to $88,600 in 2020, marking the second highest annual price point for nursing homes on record.

“It’s important to note that the long-term demographic tailwinds for the sector continue to be intact,” says Brian Chandler, co-lead for the seniors housing practice at JLL. “Many transactions in 2020 represented liquidation events since owners who are well-capitalized opted to hold and operate through the pandemic with expectations of a rebound in valuations.”

To view the full survey results, click here.