Prices are just beginning to stabilize after a 2022 wracked with catastrophes led to unprecedented rate increases.

By Jeff Shaw

As if things weren’t challenging enough for senior living owners…

Expense increases have been a major contributor to shrinking profit margins in the seniors housing space since the COVID-19 pandemic struck in 2020. Whether it’s due to increased labor costs or rising construction costs, it seems like the “L” portion of the P&L keeps growing.

We’ll add property insurance premiums to that list — 2022 was a devastating year for natural disasters, and the cost to insure a property reflects that. There were wildfires in California, Hurricane Ian and Hurricane Nicole in Florida, tornadoes in the southeast, flooding in Kentucky and Missouri, and extreme cold in Texas and the Northeast.

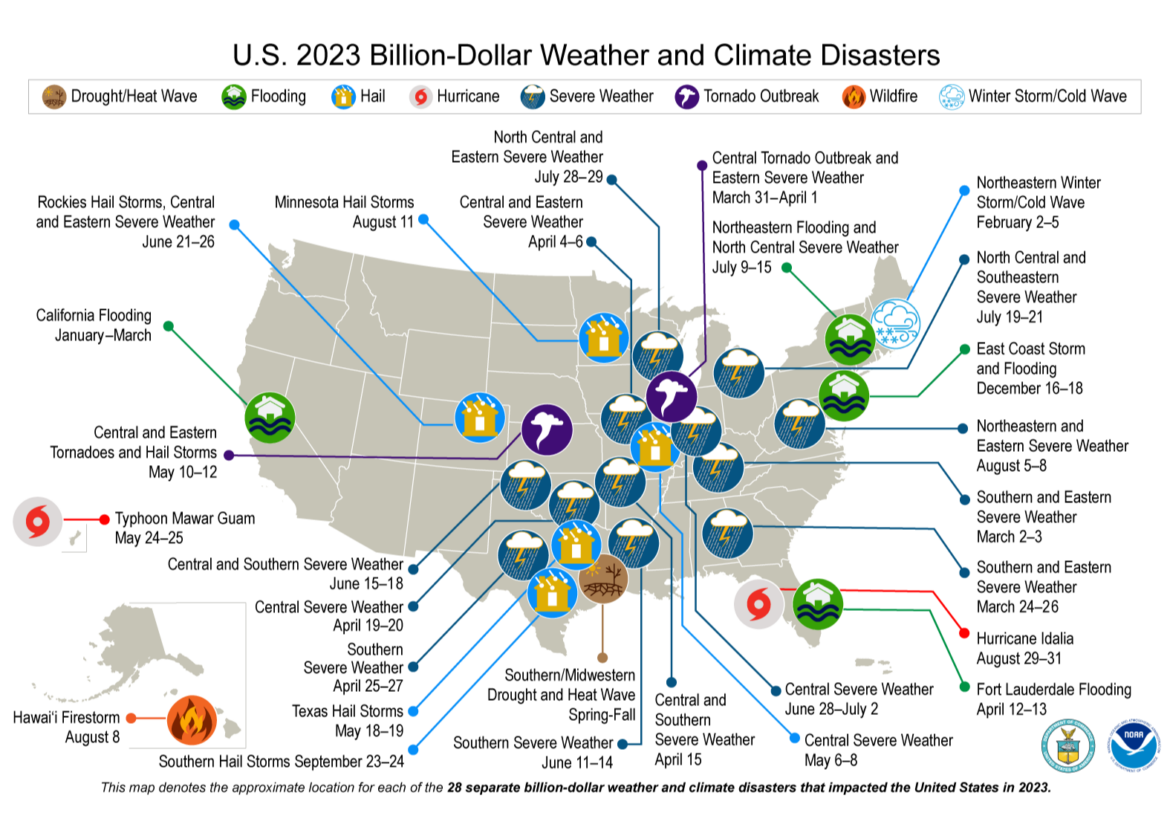

In 2022, the United States experienced 18 separate weather or climate disasters that each resulted in at least $1 billion in damages, according to the National Oceanic and Atmospheric Association. It was the third-highest year on record for total costs from disasters, totaling $165 billion.

“It’s been incredibly challenging over the last 18 to 24 months,” says John Sims, sales executive with brokerage firm Propel Insurance. “In Florida we’ve seen rates double on frame-

constructed communities, and you can’t 10 percent modify your physical plant or where you’re located geographically.”

Sims says he even had to miss church on Christmas Eve in 2022 after he received five calls regarding burst pipes that day.

“Property insurance expenses are relatively small as a percentage of total expenses, averaging only about 1 percent of total expenses — but that is up from about 0.5 percent four years ago,” explains Kevin Pascoe, chief investment officer at National Health Investors (NYSE: NHI), a publicly traded REIT. “While still a relatively small expense, the trends are alarming.”

“We have seen property insurance rate increases averaging approximately 20 percent over the last year across our largest tenants, with ranges from the mid-teens to nearly 40 percent in some cases,” continues Pascoe “At the 20 percent average, this is almost double the average annual rate that these operators experienced over the previous few years. Insurance companies have increased rates in response to consecutive years of catastrophic losses due to weather events.”

A relatively light year for natural catastrophes in 2023 has slightly mitigated the increases, notes Sims, but property owners will still feel the effects for several years to come.

“I feel like there’s a bit of a light at the end of the tunnel — we’re looking at 2025 before you see significant improvement, but I’m starting to see a lot more stability after 2022 being one of the most difficult years for property insurance that we have seen to date.”

“It seems as this year’s storm season draws to a close without any major events, the outlook for property insurance in 2024 has improved considerably,” adds Michael Welz, national seniors housing practice lead for brokerage McGriff.

“Indications from carriers seem to point toward high single-digit rate increases for preferred accounts (non-catastrophe-exposed properties, assets with no major loss history, properties of newer vintage and/or superior construction) and 15 to 20 percent increases for catastrophe-exposed properties, compared with 25 to 40 percent increases experienced by these groups last year.”

James Stuart, chief sales officer at brokerage HUB International, says that premiums have increased nearly four-fold since 2018, and that owners should expect a more than 10 percent increase in 2024, “reaching heights unseen in 30 years.”

“Many retail insurers have stopped offering renewals for residential properties,” says Stuart. “Less product means less competition.”

The underlying causes

While increasing property insurance rates affect all types of properties, seniors housing owners appear to face an outsized challenge.

“As it relates to senior living specifically, a lot of the communities are where the earth moves and the wind shakes — in catastrophe-exposed areas,” says Scott Lieber, managing director for the senior living practice of broker Marsh. “There have been a number of events in recent years that have caused insurance carriers to pay out a significant number of claims.”

“If you look at seniors housing communities, they tend to be wood frame,” continues Lieber. “We’ve seen an uptick in basic water damage claims. When you combine this over time, it’s caused carriers to look for ways to offset that exposure that they’ve been insuring. The way they do that is through increasing premiums and deductibles.”

Welz agrees, noting that popular retirement areas tend to be the most exposed to catastrophes — California, Florida and Texas are three major examples.

“There’s a large density of communities in coastal regions. These properties are often the ones that experience the most claims, though. Storms roll through, hurricanes, high winds — they cause a lot of damage. We can’t do anything to stop them from hitting these places. As a result, rates go up as fewer and fewer insurers look to insure those regions.”

The high number of catastrophes in 2022 cost the insurance carriers in another way. Reinsurance companies protect the insurance providers from facing too many losses at once — essentially insuring the insurers. Those companies have also increased their rates as they had to pay out more claims in 2022 as well.

“Every year the markets that provide property insurance go through reinsurance negotiations,” says Justin Dickinson, partner Evolve Senior Living, an owner-operator. “That’s a big item for them because it basically sets prices based on what they need to pass through to us.”

“Last year’s reinsurance treaties have been difficult for the insurance carriers as well,” says Lieber. “A lot of that works its way down to the insured.”

This was exacerbated by full-loss claims, adds Welz.

“As full-limit losses were paid, the primary insurance market was passing on significant claims to the reinsurance market. The reinsurers said, ‘We’re supposed to be in case of emergency. You’re calling us too much.’”

Another change that could be affecting owners: An increase in replacement cost. Welz cites a 2022 Travelers Insurance study showing that 75 percent of properties were underinsured by 40 percent or more. So, a $100 million property would only be covered up to $60 million, for example.

This is partially due to the increase in construction costs, meaning that a building that cost $10 million to build now costs $20 million to replace.

“Just over time, as construction costs have risen, carriers may or may not have been carrying the right replacement costs on their books,” says Dickinson. “When they have to pay out, that delta between what they thought they were insuring and what it actually cost caused rates to increase.”

“The good news is that the valuation adjustments that were mandated by the insurers throughout the last year have all been carried out,” adds Welz. “You don’t have as many owners carrying obsolete values on their buildings.”

Solving the ‘puzzle’

As owners bristle at the new cost of property insurance, it falls on the brokers to try and find an affordable solution for their clients. This has led to some extremely complicated transactions.

“Every property insurance renewal has nuances and is a puzzle,” says Sims. “You might have an operator with communities in 25 different states, and you’re thoroughly analyzing the type of construction and updates down to the community level.

“I’ve had scenarios where we carved up a portfolio multiple ways based on geography and a carrier that might only write Midwest exposure taking that, and with others insuring different perils based on acuity levels, location and construction detail.”

Lieber says that Marsh similarly has been forced to get creative to bring down costs for clients.

“There are a number of other creative solutions in the insurance marketplace. Everybody should be having that conversation.”

Welz says some of McGriff’s clients are rebalancing catastrophic loads within their insurance programs — with wind coverage being a particular point of emphasis. In other words, carving out standalone wind-damage insurance policies from master policies, out of necessity, as a means to insure more challenging risks.

NHI’s Pascoe notes that some operators have asked to work with lower-rated insurers that cost less, but the REIT doesn’t allow that. Instead, the company uses its size to obtain better rates and mitigate some of that cost pressure.

Insurers are often willing to reduce their policy rates in exchange for owners increasing the safety of their properties. Fire prevention and safety measures, insulation of pipes to prevent bursts and sturdier materials are all ways to make a property easier to insure.

“Fire prevention surrounding the property, roof updates and adequate sprinkler protection are all examples of things an underwriter will consider when determining rate,” says Pascoe. “Information on the property’s condition, foundation connection, roof anchors and age can all impact rate along with documentation regarding plumbing and electrical updates.”

“Owners need to exercise all channels to mitigate claims,” says Jason Zuccari, managing director at Hamilton Insurance Agency. “For property insurance that means making sure the building is properly maintained with functioning fire and smoke alarms and sprinkler systems in all areas (including attics and crawl spaces).”

Sims encourages owners to work with their broker and carrier partners as to all possible placement structures, and to have a plan for mitigation before a weather incident strikes.

“Get creative. Push carriers to kick in rate relief to be used for CapEx infusion; be proactive with implementing property risk management and compliance plans,” says Sims. “All these pipes didn’t have to burst. You can mitigate. Obviously, you can’t change the weather patterns, but we can analyze those patterns to prepare.”

This carries value beyond stabilizing your insurance spend, continues Sims. Something as simple as a burst pipe is stressful for all parties — residents, team members and ownership. Taking measures to prevent the incident alleviates stress and also helps build culture.

“In general, carriers are asking for much more information about building protective features such as sprinkler system capacity and spread,” says Brant Watson, senior vice president at Heffernan Insurance Brokers. “More often, carriers require a loss control inspection before considering terms. Optimizing and documenting plant maintenance best practices is critical during these visits.”

There’s also the path that owners might be afraid of — taking on less insurance, essentially shouldering more of the risk themselves, whether through higher deductibles or self-insurance.

“This is more of a risk-financing strategy, but more and more owners are basically going down the path of taking larger deductibles,” says Welz. “Instead of allowing the insurer to come in on a first-dollar basis, many people are starting to look at taking the first layer of risk off the table — maybe $250,000 to $500,000. They’re taking that first cut out and insuring themselves, with the insurance companies stacking above that.”

Welz goes on to note that brokers have to be ahead of the game to ensure that property owners know what’s coming.

“Here’s where brokers get themselves in trouble. You can’t surprise your clients in a market like this. We have to have conversations early and proactively and set expectations early.”

With necessity being the mother of invention, Welz suggests that the creativity resulting from these sudden rate increases could pay long-term dividends.

“Under intense periods of pressure, it creates a good incubator for innovation.”