DALLAS — The Seniors Housing & Care Investor Survey, conducted each year by Dallas-based CBRE Research, shows that capitalization rates are on the rise, and many expect that trend to continue.

The survey focuses on rapidly changing market conditions due to inflation, staffing shortages and rising interest rates. CBRE’s methodology and pool of respondents was not disclosed with the survey results.

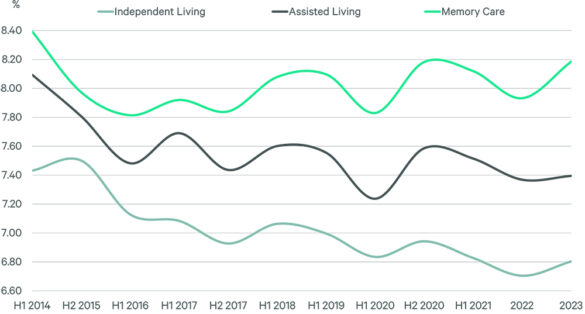

The average seniors housing capitalization rate increased by 26 basis points year over year, and survey respondents view assets with the lowest cap rates as those most negatively impacted by rising interest rates.

Nearly 50 percent of respondents said they expect cap rates will increase in 2023, compared with only 27 percent of respondents last year.

The active adult segment led expectations of risk-adjusted returns, with 37 percent of respondents viewing the class as the biggest investment opportunity in 2023.

Over 75 percent of respondents expect rental rate increases of 3 percent or more across nearly all seniors housing classes.

Difficulty in maintaining adequate staffing levels ranked as the greatest headwind facing the seniors housing industry this year.

The view the full report, click here.