On its surface, now is a difficult time to be in seniors housing development or operations. Rising interest rates have made financing or refinancing challenging. Occupancy rates, while improving, are still well below pre-pandemic levels. Expenses have increased dramatically, particularly for labor, while rent increases haven’t been able to keep up.

JP LoMonaco, now an appraiser with CBRE after the company bought his former appraisal firm Valuation & Information Group in June, notes that the work he does reflects the tough times.

“We saw a sudden shift from new loan appraisals to more being done for workouts and bankruptcy proceedings,” said LoMonaco. “However, history tells us that fortunes and wealth are created in times like this. This discussion will focus on bucking the trends and finding ways to move forward.”

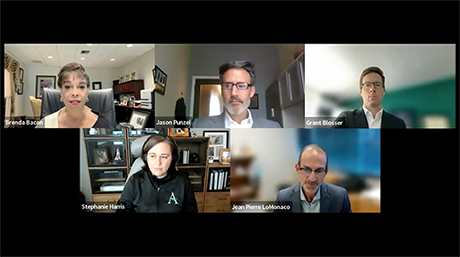

LoMonaco made these comments as moderator of a webinar titled “Seniors Housing Success Stories — Companies that are Rising Above the Headwinds” held June 29. Panelists included Brenda Bacon of Brandywine Living, Stephanie Harris of Arrow Senior Living, Jason Punzel of Senior Living Investment Brokerage and Grant Blosser of VIUM Capital.

Turning to the operators first, both Harris and Bacon reported good news: Leasing has been extremely strong for new communities.

“Every building we opened from late 2021 through 2022 showed our fastest lease-up ever, even better than pre-pandemic, which is pretty exciting,” said Harris.

She was quick to add, though, that starting new developments now is extremely difficult due to heightened interest rates.

“We were really fortunate to get those projects done ahead of the rising costs of construction. We’re now at a third of our usual development volume, and many others are ‘pencils down.’”

Bacon noted that the two buildings Brandywine opened during the pandemic also leased up very quickly. Her takeaway, though, is that the industry as a whole needs to stop looking back at pre-pandemic norms and instead push forward into something better.

“Look at the signals we’re seeing now as we go forward, at what people’s choices are. There’s certainly some indication that people waited out the pandemic at home and are coming in a bit more compromised. But we’re also seeing a lot of couples come in, where before one might have taken care of the other. We’re seeing a lot of people making conscious choices to move.

“There are a lot of positive signals out there. If we could move forward on those we’d make more progress than thinking everything will return to pre-pandemic.”

Harris added that in addition to more couples, Arrow is seeing a higher percentage of male residents.

Financing complicates matters

LoMonaco later changed the topic to the finance end of seniors housing and turned to the panelists who specialize in that field.

Punzel reported that premier, stabilized properties have seen only a modest price dip of 5 to 10 percent due to high interest rates and low occupancy. However, that type of property now only makes up about 15 percent of SLIB’s deal volume.

“The other 85 percent are properties that are not stabilized in some capacity. Those prices have dropped at least 15 to 20 percent compared to where they were 18 months ago.”

Punzel noted that buyer demand is there for value-add properties — but the financing isn’t.

“Unfortunately, the amount of nonrecourse debt available for non-stabilized properties is almost non-existent today. There’s only two ways to finance it today: With a regional, local bank with a good relationship, with some type of recourse on that debt.”

“The bid-ask spread has come in quite a bit,” adds Punzel. “Sellers are realizing the prices aren’t what they were 18 months ago.”

Both Punzel and Blosser said that deals are still getting done, but that they require more creativity. Punzel said there are a lot more debt assumptions by the buyer as part of a sale, as well as seller financing — where the previous owner provides the acquisition loan to the buyer.

Blosser said he recently saw one property sell using 100 percent seller financing, calling it an “operate to own” sale.

“The seller said, ‘You take the keys, you start operating it, you own it.’ But the buyer basically has an IOU to the seller to pay them full purchase price within three years. It’s a 6 percent fixed interest rate. In this environment, that’s fantastic.”

“The underlying theme for not stabilized facilities is creativity,” concluded Blosser.

The watch the full webinar, click here.

— Jeff Shaw