ALEXANDRIA, Va. — Oxford Finance LLC, an Alexandria-based specialty finance firm that provides senior debt to life sciences and healthcare services companies worldwide, provided $867 million in healthcare real estate loans in 2022. The total was an annual record for the company’s Healthcare Real Estate Group, which closed a total of 14 transactions, with credit facilities ranging from $9 million to over $124 million. Highlights included: Oxford provided an $80.8 million term loan and an $8.5 million revolving line of credit to finance the acquisition of four healthcare campuses comprised …

Finance

Ziegler Arranges $29.2M Financing for Bishop Gadsden Expansion in Charleston, South Carolina

CHARLESTON, S.C. — Ziegler has arranged $29.2 million in bond financing to fund a renovation project at Bishop Gadsden Episcopal Retirement Community in Charleston. The nonprofit continuing care retirement community is located on James Island, approximately six miles from downtown and six miles from Folly Beach. Founded in 1850 as a special ministry of the Episcopal Diocese of South Carolina, Bishop Gadsden has continuously expanded its mission to serve seniors for 173 years and remains affiliated with the Episcopal diocese. In 1987, Bishop Gadsden moved to its current location on …

NEW YORK CITY — Dwight Capital and its affiliate REIT, Dwight Mortgage Trust, financed over $191 million in seniors housing financing during fourth-quarter 2022. The Manhattan-based financial services firm closed a $39 million bridge loan to facilitate the acquisition of a two-property skilled nursing portfolio in Fort Lauderdale, Florida: Manor Oaks and Manor Pines. The facilities are three miles apart and comprise 322 beds across approximately 111,800 square feet. Adam Offman originated the transaction. Offman also originated a $24.3 million bridge refinancing for a portfolio of two skilled nursing facilities …

SACRAMENTO — Lument has provided a $7.5 million Fannie Mae loan to refinance Carlton Senior Living, a 56-unit assisted living community in Sacramento. Built in 2008, Carlton Senior Living is located on the Carlton Senior Living Continuum of Care Campus, next to a 128-unit assisted living and memory care community that was refinanced in 2016, also with assistance from Lument. When it first opened, Carlton Senior Living was serving high-acuity assisted living residents. In 2021, the borrower altered its strategy and catered it services more toward traditional assisted living. The …

ESCONDIDO, Calif; SAN ANTONIO; and WINSTON-SALEM, N.C. — Cushman & Wakefield has arranged $51 million in financing for Kisco Senior Living. The loan refinances debt on three Kisco properties: Cypress Court in Escondido, Villa de San Antonio in San Antonio and Heritage Woods in Winston-Salem. The properties provide independent living and assisted living services. Cushman & Wakefield’s Rick Swartz, Jay Wagner, Aaron Rosenzweig, Dan Baker and Sam Dylag represented the borrower in the transaction. A national bank provided the capital.

HATFIELD, SOUDERTON and LANSDALE, Pennsylvania — Ziegler has arranged $19 million in bond financing for Living Branches, a nonprofit seniors housing and affordable housing operator. Living Branches was founded in 2008 upon the merger of Dock Woods, a life plan community founded in 1981 in Lansdale, and Souderton Mennonite Homes, a life plan community in Souderton originally founded in 1917. The corporation also operates The Willows of Living Branches, a personal care community in Hatfield founded in 1942, and two HUD housing organizations located on the Dock Woods campus. The …

ALBUQUERQUE — JLL Capital Markets has arranged $51.8 million in construction financing for the development of Ativo of Albuquerque, a three-story, 144-unit senior living community in Albuquerque. JLL represented the borrower, Link Senior Development LLC, in securing the financing through an undisclosed lender. Once completed, Ativo of Albuquerque will offer a mix of independent living, assisted living and memory care units ranging from studio to two-bedroom units. Situated on 6.5 acres, the community will be adjacent to a new ambulatory urgent care center and a medical office building. The community …

MassHousing Provides $13.5M in Financing for Riverside Towers Affordable Complex in Medford, Massachusetts

MEDFORD, MASS. — MassHousing has provided $13.5 million in financing for Riverside Towers, a 199-unit affordable seniors housing complex in Medford, located north of Boston. Built in 1979, Riverside Towers consists of 161 one-bedroom and 38 two-bedroom units in a 14-story building. The borrower, a partnership between metro Boston-based Schochet Cos. and Jonathan Rose Cos., will use the proceeds to fund capital improvements, enhance resident services and preserve the property’s affordability status.

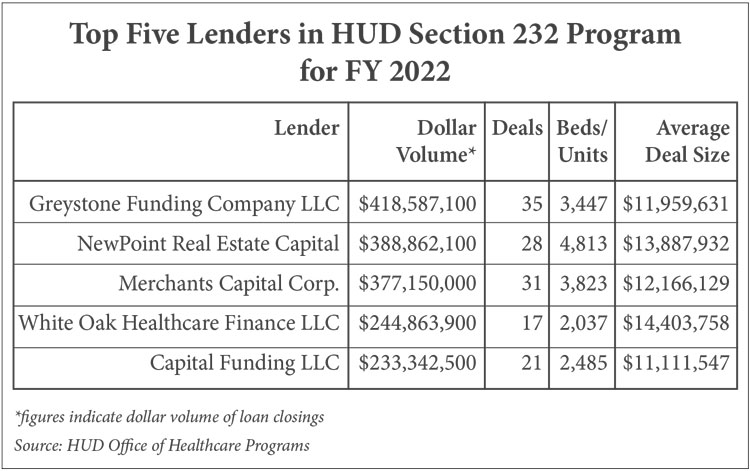

By Matt Valley A spike in interest rates coupled with operational challenges in the skilled nursing and seniors housing industries stemming from the COVID-19 pandemic took a toll on lending volume in HUD’s Section 232 mortgage insurance program in fiscal year (FY) 2022. Annual lending volume fell to $2.95 billion from $3.94 billion the prior year, a 25 percent drop. The number of transactions also decreased from 328 to 269, an 18 percent decline. “The biggest surprise in 2022 was not that interest rates went up, but how drastically and …

Ziegler Closes $47M Financing for Construction of Saint Therese Community in Corcoran, Minnesota

CORCORAN, Minn. — Specialty investment bank Ziegler has closed on $47 million in financing for Saint Therese of Corcoran LLC, and its sponsor, Saint Therese, for the construction of a new senior living community in Corcoran, about 30 miles northwest of Minneapolis. The financing is comprised of $18.2 million of Series 2022AB and $28.8 million of Series 2023 Senior Living Revenue Notes placed with Bremer Bank. Proceeds of the notes, along with other available funds, will be used to finance the construction of Saint Therese of Corcoran, fund interest on …