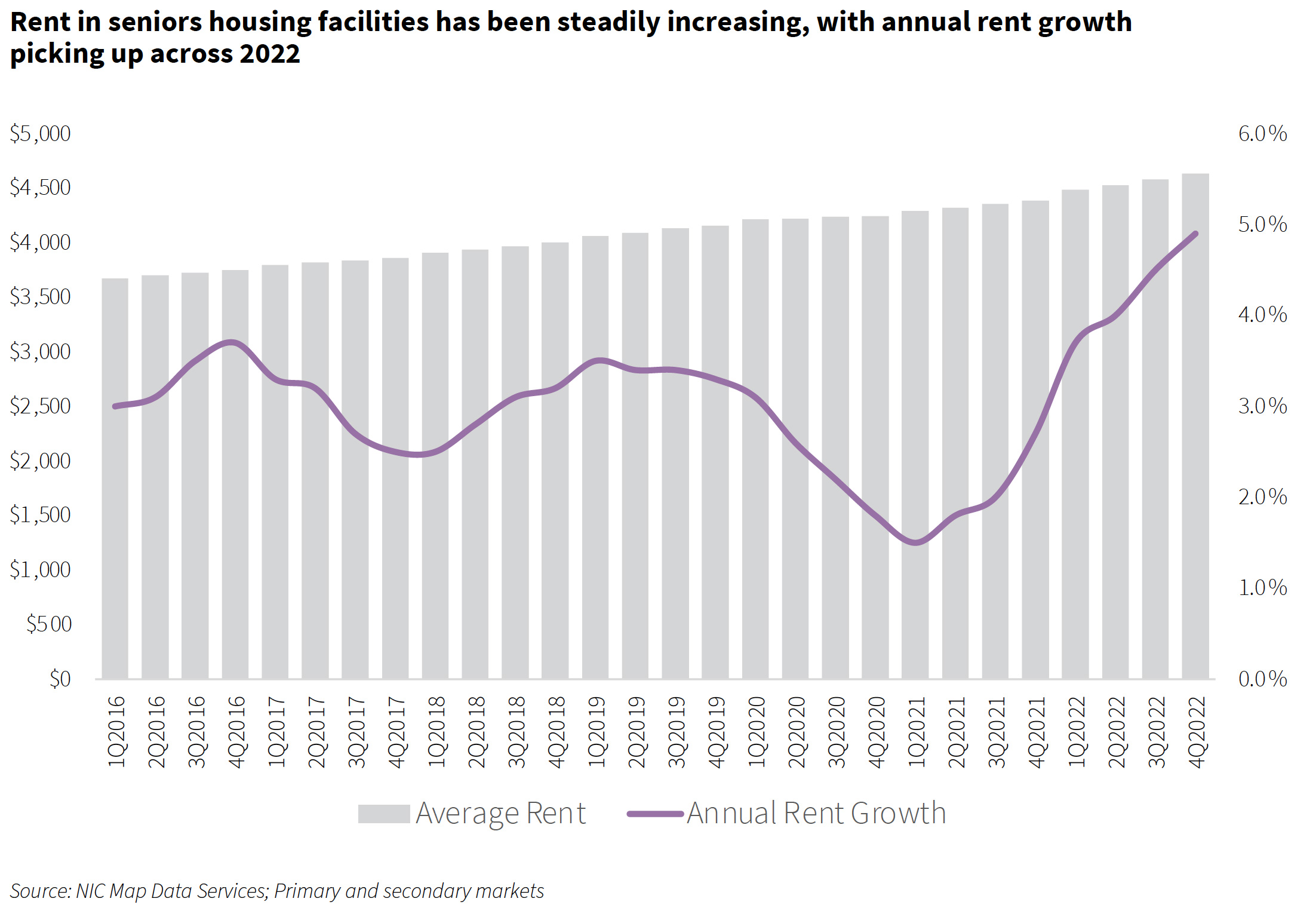

CHICAGO — Despite pricing uncertainties limiting capital markets activity, interest in seniors housing remains strong as investors seek higher yields from alternative asset classes, according to JLL’s Valuation Advisory group’s sixth annual Seniors Housing Investor Survey and Outlook. Of the investors surveyed by the Chicago-based valuation group, 44 percent indicated they would increase their exposure to seniors housing in 2023, and 44 percent said they would make no change to their current investments. Only 12 percent of investors surveyed responded that they would decrease their exposure in 2023. Investors are …

Investment

Rockwood Capital, Doyenne Healthcare Capital Launch $100M Seniors Housing Joint Venture

NEW YORK CITY and CHICAGO — Rockwood Capital and Doyenne Healthcare Capital (DHC) have formed a joint venture to invest up to $100 million of equity in seniors housing communities across the country. Financial terms of the venture were not disclosed. “We view seniors housing as a complementary strategy for our existing ‘live-space’ investment program,” says David Becker, co-managing partner of Rockwood. “We believe that significant demographic tailwinds continue to support the sector. We also believe that the operational disruption caused by the pandemic coupled with the current capital markets …

WESTLAKE VILLAGE, Calif. — LTC Properties Inc. (NYSE: LTC), a Westlake Village-based real estate investment trust that primarily invests in seniors housing and healthcare properties, has made a $128 million investment in 12 assisted living/memory care properties totaling 937 beds and 568 units across North Carolina. An existing LTC partner operates all the communities. The majority of LTC’s $128 million investment is structured as a joint venture and a minor portion is structured as a senior mortgage loan secured by one property. The investment was funded from approximately $99 million …

Seniors Housing Investors Should Look for Opportunities Amid Today’s Challenges, Says Webinar Panel

It has undoubtedly been a very difficult time for seniors housing owners, operators and investors. The COVID-19 pandemic led to widespread shutdowns that forced communities to turn away visitors and prospective new residents for months, which in turn caused occupancy rates to crater. Then, just as the industry started to come back, labor challenges, inflation and rising interest rates put the brakes on that recovery. “We’ve been through the most unusual period ever for our industry,” said JP LoMonaco, president of Valuation & Information Group. LoMonaco made those comments while …

CareTrust REIT Appoints James Callister as Successor to Mark Lamb as Chief Investment Officer

SAN CLEMENTE, Calif. — The board of directors of CareTrust REIT Inc. (NYSE: CTRE) has appointed James Callister as chief investment officer. Effective at the end of the year, Callister will succeed Mark Lamb, who plans to leave the company after a transition period to pursue entrepreneurial opportunities. Callister has served as executive vice president and secretary at CareTrust since July 2022. He previously served as general counsel and secretary from February 2021 to July 2022. Prior to joining CareTrust, he worked as a real estate attorney and a partner …

A Port in the Storm Omega Healthcare Investors rides out recessions, regulatory sea changes and pandemics to remain one of the largest owners of senior care facilities. By Jeff Shaw Omega Healthcare Investors launched in a way that was extremely unusual at the time. Essel Bailey Jr. founded the company in 1992, but had few assets to show — $400,000 in cash and a contract to buy 37 skilled nursing facilities for $120 million. Omega was started in a manner similar to what today is known as a special purpose …

Macroeconomic conditions are slowing the pace of seniors housing transactions and squeezing the availability of capital. Inflation and rising interest rates are making deals more expensive to finance. Debt providers are tightening their underwriting terms, while equity investors sit on the sidelines worried about shrinking margins. Overall, the outlook for the upcoming year looks choppy, according to investors and lenders speaking at France Media’s sixth annual Interface Seniors Housing Midwest conference. But they’re still bullish on the long-term prospects of the seniors housing market, with demand set to pick up …

LOS ANGELES — Standard Communities, a Los Angeles-based investor and developer of affordable multifamily housing including seniors housing, has established three new, diversified business lines. The three dedicated business lines — acquisition/redevelopment, new construction and essential housing — aim to leverage and align the strengths and diversity of Standard’s staff and enable them to execute faster and more efficiently. “With our national geographic reach and ambitious vision for the future, it is important that our structure allows us to stay nimble and responsive to opportunities,” says Scott Alter, co-founder and …

Steps to Help Small Seniors Housing Owners Prepare for a Sale

The seniors housing market has had its fair share of well-documented struggles, including plunging occupancies during COVID-19 and continuing labor challenges. Like the rest of the commercial real estate market, the sector is now confronting higher interest rates and recession. Despite those headwinds, investor demand for seniors housing assets remains strong, says Dawn Davis, an advisor specializing in seniors housing and skilled nursing with NAI Greywolf in Milwaukee. But sellers are only now grudgingly coming to terms with the fact that, because capital has become more expensive, the price buyers …

Economic Headwinds Don’t Slow Optimism in Seniors Housing Industry, Say Webinar Panelists

How about this: It’s never been an easy ride for the seniors housing industry, even in the good times, but the last few years have been particularly turbulent. “Our industry has been through a real roller coaster the past couple years, starting off with the pandemic,” said Rick Swartz of Cushman & Wakefield. “That was a real challenge to occupancies and operations. We then had a successful roll out of vaccines that led the recovery and created a lot more bullishness in the industry. However, our robust economy has led …