Cap rates rose across all types of seniors housing between October and March, and investors largely expect rent growth to continue, though at a slower rate than in recent years.

That’s according to CBRE’s U.S. Senior Housing & Care Investor Survey H1 2024 report, which was released this week.

According to respondents, who represent a variety of industry executives within seniors housing real estate, skilled nursing cap rates increased by 11 basis points (bps) between October 2023 and March 2024, after increasing by 71 bps over the previous six months.

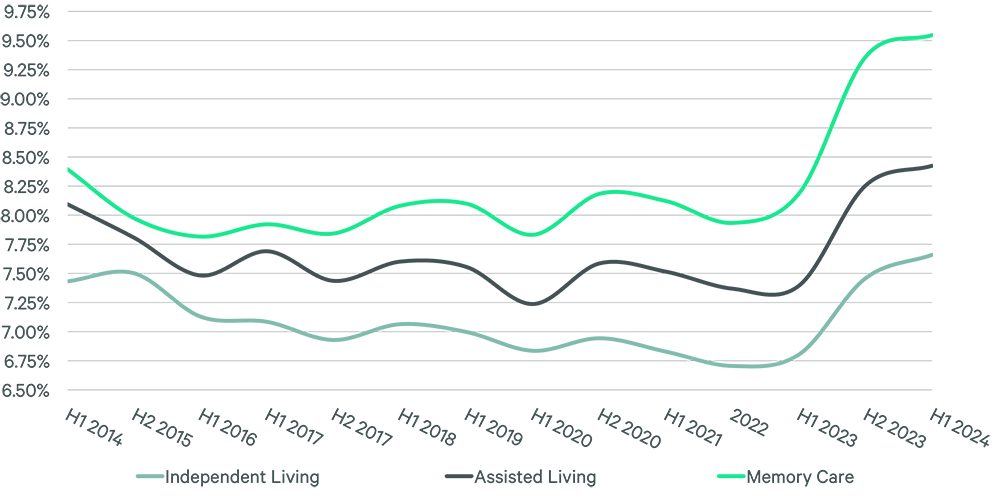

The average cap rate for active adult communities increased by 15 bps in the same span. Average cap rates for independent living, assisted living and memory care facilities increased by 17 to 20 bps over that span, with greater increases for Class C assets than Class A and for non-core markets than core. This is a reversal from the prior survey, which reported the biggest increases for Class A assets and core markets.

Despite these average increases based on total survey responses, 45 percent of survey respondents reported no change in seniors housing cap rates from the prior survey.

The capitalization rate, or cap rate, is the unlevered initial expected return from the acquisition of a real estate asset. The cap rate is calculated by dividing the net operating income by the property sales price. The rule of thumb is the higher the cap rate, the greater the risk and return.

For active adult, independent living, assisted living and memory care facilities, 63 percent of survey respondents said they expect rental rate increases of 3 to 7 percent over the next 12 months. However, the percentage of respondents who reported underwriting rent growth above 7 percent fell to 3.9 percent in the April 2024 survey from 15.6 percent in the October 2023 survey.

To view the full survey results, click here.