Deal volume in the Section 232 program fell 3 percent to nearly $2.87 billion in FY 2023, but signs of a rebound emerge.

By Matt Valley

Considering the body blows the seniors housing industry absorbed coming out of the COVID-19 pandemic — including a spike in interest rates, inflation and labor issues that negatively impacted net operating income — deal volume in HUD’s Section 232 healthcare mortgage insurance program for fiscal year (FY) 2023 was solid, say lenders.

Annual lending volume decreased 3 percent to nearly $2.87 billion, while the number of loans closed in the program fell from 269 to 196, a 27 percent decline year over year. Meanwhile, the average deal size increased from just shy of $11 million in FY 2022 to $14.6 million in FY 2023.

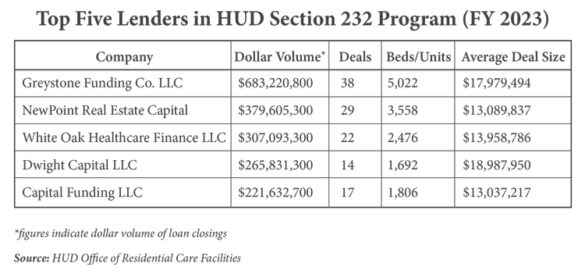

“This [spike in the average deal size] makes sense because the larger facilities have the economies of scale to mitigate some of the increase in operating expenses associated with our current inflationary environment,” says Chris Clare, managing director at Greystone. The company ranked as the top lender in the HUD Section 232 loan program for the fourth consecutive year. Greystone closed 38 loans totaling $683.2 million in FY 2023.

“When we sat down for our fiscal year 2023 planning meeting, we took a sober view of the economic environment. Together with our clients, we are navigating an extraordinarily difficult period. As we plan for 2024, we are preparing for two competing dynamics: interest rates will be higher for longer and availability of bank capital will continue to be scarce. Demand for our bridge and HUD loans will be very strong,” says Clare.

HUD’s Office of Residential Care Facilities manages the Section 232 program, which provides mortgage insurance for residential care facilities such as assisted living facilities, nursing homes, intermediate care facilities, and board and care homes. The program allows for long-term, fixed-rate financing up to 40 years for new and rehabilitated properties and up to 35 years for existing properties without rehabilitation that can be financed with Government National Mortgage Association (GNMA) mortgage-backed securities.

One key reason Greystone has remained the top lender in the HUD Section 232 loan program for four years running is its bridge lending arm, Greystone Monticello, which has a robust pipeline, according to Clare.

“Overall demand for our bridge capital has increased exponentially over the past 18 months. While many of our competitors are on the sidelines, our disciplined approach has led to strong credit performance within our portfolio. This allows us to attract institutional capital even in these challenging times. We are definitely open for business,” says Clare.

What a difference a year makes

The sharp rise in the interest rates has taken its toll on the 232/223(a)(7) loan program, which enables borrowers to take advantage of lower interest rates and extend the remaining term of their loans, according to Michael Gehl, chief investment officer for FHA lending at NewPoint Real Estate Capital. The company ranked second in loan production among HUD lenders with $379.6 million in deal volume and 29 loans closed in FY 2023.

There were 95 (a)(7) loans originated in FY 2022, but only 20 in FY 2023, according to HUD. “Although this program was very attractive in early 2022, with the increase in interest rates starting in the middle of 2022, (a)(7) loans could not generate interest rate savings and, as a result, were reduced substantially year over year.”

Additionally, an operating loss loan program that was put in place temporarily coming out of the COVID-19 pandemic, went away in 2023. There were 23 such loans in FY 2022, but that figure went to zero in FY 2023.

Steve Kennedy, executive managing director at VIUM Capital, points out that the 23 operating loss loans originated in FY 2022 averaged about $750,000 per loan. “Those loans artificially increased the number of closed loans, decreased the average loan size, and is not a loan type that exists anymore.”

Industry headwinds, tailwinds

Jason Smeck, a director at Lument specializing in seniors housing and healthcare production, says the HUD Section 232 loan program is weathering the storm about as well as could be expected amid volatile market conditions. He points out that the Federal Reserve has hiked interest rates 11 times since March 2022, taking the federal funds rate from near zero to a target range today of 5.25 percent to 5.5 percent.

“Borrowers and lenders are now in an interest-rate environment that has shifted dramatically with scarce opportunities to create debt-service savings through simple refinances,” emphasizes Smeck.

The annual lending volume of nearly $2.87 billion in the HUD Section 232 program for FY 2023 was the lowest of the past five fiscal years, the Lument executive acknowledges. “However, for a seniors housing and healthcare industry that is still struggling with a host of big challenges coming out of the pandemic, while at the same time dealing with a rising-interest-rate environment, I actually consider HUD’s Section 232 volume for fiscal year 2023 to be solid given the circumstances,” says Smeck.

Furthermore, “HUD has maintained its underwriting debt-service coverage ratio and loan-to-value thresholds without pulling back into more conservative stances,” he adds.

Lument ranked as the eighth biggest producer in the HUD Section 232 program in FY 2023 with 13 loans closed totaling $129.48 million.

Smeck says it’s important for borrowers and lenders to come to grips with the reality that the debt financing environment is vastly different today than it was just a few years ago, which will have a meaningful impact on all lending volume in the near term.

“In the past 18 months, the yield on the U.S. 10-year Treasury note has increased nearly 300 basis points and is approaching 5 percent. Prior to October 2022, it had been 14 years (June 2008) since the yield on the 10-year U.S. Treasury note was above 4 percent.”

Because the 10-year yield is a benchmark for mortgage rates in the HUD universe, its every move is closely tracked.

“One can take the stance that we are dealing in days of unusually high interest rates, or the stance that it was unusual that interest rates were so low for 14 years. But either way, the current market is dramatically different than what we have seen in recent history,” says Smeck.

Seniors housing and healthcare communities across the country are still in recovery mode coming out of the pandemic, explains Smeck. “We have seen some buildings that have experienced strong recoveries and are more successful today than before COVID, but clearly that’s not the case for everyone. And even if a community has recovered from a census standpoint, it may still face challenges in terms of expenses.”

A range of factors such as staffing availability and retention, inflation, expense creep, and a dramatic increase in property insurance premiums in certain markets has resulted in margin compression, explains Smeck. “When combined with higher interest rates, all of this results in much tougher transactions, many of which are now constrained by underwritten debt-service coverage.”

Turnaround afoot

The occupancy rate nationally for skilled nursing increased 59 basis points from July to August to reach 82.3 percent, according to NIC MAP Vision. Occupancy is up 142 basis points from August 2022 as it continues to recover since the pandemic low of 75 percent set in January 2021.

Meanwhile, the assisted living occupancy rate within the 31 NIC MAP Primary Markets rose 90 basis points between the second and third quarter of this year to reach 82.6 percent.

The improving real estate fundamentals have given a big boost to the 232/223(f) loan program, notes Gehl. The 223(f) program offers non-recourse, fixed-rate, long-term financing for the acquisition or refinancing of existing senior living and healthcare facilities.

Volume in the 223(f) program during FY 2023 totaled nearly $2.7 billion compared with $1.85 billion in FY 2022, a 46 percent increase. The number of 223(f) loans rose from 148 to 175 year over year.

“The market is recovering, as exemplified by the 223(f) volume moving in the right direction. Total volume has not yet returned to 2019 levels, but we are getting closer. We are seeing occupancies ticking upward, [Medicaid] reimbursement rates increasing in many states, and labor challenges abating,” explains Gehl.

“We expect HUD lending in this sector to steadily keep increasing in proportion to improvements in market conditions until we make a full comeback to pre-pandemic levels. That’s not likely to occur in fiscal year 2024, but we’re hopeful for fiscal year 2025,” adds Gehl.

‘Working in the dark’

VIUM Capital, which launched in 2020, closed eight loans totaling $114 million in FY 2023, a substantial decrease from $352 million in deal volume and 30 loans closed in FY 2022. Still, VIUM was the ninth largest HUD loan producer in FY 2023. The majority of loans originated by VIUM in FY 2022 were a combination of (a)(7) loans and 223(f) loans.

“With the increase in rates and our relatively new bridge loan book, we knew fiscal year 2023 would be a year of allowing our bridge book to further mature and the beginning of a continued onslaught of HUD 232/223(f) application submissions to pay off those bridge loans,” says VIUM’s Kennedy, who previously worked for Lancaster Pollard as a senior managing director..

“Internally we coined fiscal year 2023 as our year of ‘working in the dark’ for the success we would see in fiscal year 2024. That has now started to come to fruition, as we secured 14 HUD 232/223(f) commitments in the final quarter of fiscal year 2023, setting up a fiscal year 2024 where we plan to be the leading HUD healthcare lender in the country.”

What’s next?

Private-pay seniors housing is still approximately a year away from reaching pre-pandemic net operating income levels because it will take time for occupancies and rents to catch up with inflationary pressures on the expense side, says Kennedy.

Skilled nursing is closer to pre-pandemic net operating income levels for two reasons, explains Kennedy. First, it is more of a need-based product. Second, Medicaid rebasing (an adjustment in the reimbursement rate) has kicked in across many states to capture the increased costs incurred by skilled nursing facilities during COVID.

“Given the above, the lack of permanent financing options for skilled nursing facilities and HUD’s still relatively favorable cost of capital (fixed rates of approximately 6 percent) and favorable loan terms (a 35-year amortization and non-recourse debt), we expect HUD’s fiscal year 2024 to potentially return to pre-pandemic deal volume approaching $4 billion,” says Kennedy.