Deal volume of nearly $4 billion in FY 2021 helped fill void during pandemic.

By Matt Valley

Amid an extremely challenging operating environment for the seniors housing industry and a difficult underwriting situation for lenders due to the pandemic, one source of debt financing has stood tall.

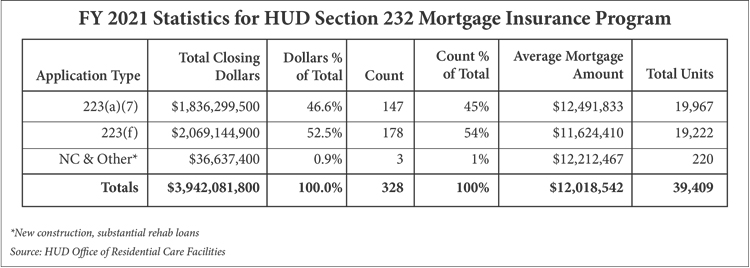

Lenders in the U.S. Department of Housing and Urban Development’s Section 232 healthcare mortgage insurance program used to finance nursing homes, assisted living and board and care facilities closed $3.94 billion in loans in fiscal year (FY) 2021, which ended Sept. 30. Total volume fell 10 percent from the $4.38 billion in loans closed the prior year.

In addition, HUD lenders completed 245 loan modifications, also known as interest rate reductions, that are not included in the FY 2021 totals. For example, Housing & Healthcare Finance LLC closed $585 million in loan modifications during FY 2021 as borrowers took advantage of a 10-year Treasury yield that began the fiscal year hovering around a paltry 0.7 percent. As of press time in mid-November, the 10-year Treasury yield stood at about 1.5 percent.

Given the significant occupancy declines and staffing issues the industry had to grapple with over the course of the year, the 10 percent drop in annual deal volume hardly feels like a miss, say industry experts.

“HUD did an amazing job last year when the pandemic hit and provided the liquidity that borrowers needed at a time when many of the banks were scrambling and running for the exit,” says Erik Howard, executive managing director at Capital Funding Group (CFG).

The federal agency was doing everything possible to get a handle on underwriting facilities during the middle of a crisis, explains Howard. “The byproduct is that it took a little longer to get things done. There were shifting tides obviously, particularly in the middle of the year when we started to see the Delta variant of COVID-19 ramp up. That gave HUD some pause as it continued to work through the crisis.”

Jason Smeck, a director at Lument, concurs with Howard. “Keep in mind that this was a time during which lockdowns were occurring, visitations and activities within senior living facilities were severely curtailed, and there was massive transitioning among the workforce. HUD stepped up and kept its foot on the pedal during all of this disruption.”

Negative trends in infections, occupancy levels and financial performance pushed many applications into a “hold” status at HUD, which created processing backlogs and bottlenecks that are still an issue today, observes Smeck.

As of Nov. 12, there were 90 loans in underwriting review at HUD, and another 91 loans in the queue but not yet assigned.

Greystone leads the pack

Lenders closed a total of 328 loans through the HUD 232 program in FY 2021, up slightly from 323 loans the prior year. The average mortgage amount fell from $13.5 million to $12 million year over year (see table).

The top originator by dollar amount in the HUD Lean 232 program in FY 2021 was Greystone with nearly $888.9 million in total volume spread across 71 deals. Housing & Healthcare Finance ranked second with close to $552.9 million in loans closed and 35 deals.

Coming in third was Walker & Dunlop with nearly $309.4 million in loans closed and 27 transactions. Rounding out the top five list of originators were Dwight Capital at approximately $273.4 million in loan volume and 20 deals, and CFG with nearly $268.9 million in loans closed and 24 transactions.

If Greystone were to add in the approximately $400 million in loan modifications the company completed during FY 2021, its combined annual total via the HUD 232 program would be $1.3 billion, down from $1.5 billion a year ago.

“We had projected significantly less volume for the year, not knowing how things were going to shape up as COVID was protracted. Maybe we were a little too cautious with our projections,” says Scott Thurman, chief credit officer for FHA lending at Greystone, who is optimistic about the near-term outlook for the sector.

“I’m hopeful that if we have a mild flu season and don’t have to contend with more COVID variants, and with the third vaccination rounds being rolled out, we can get back to business as usual. I think that there will be a lot of pent-up demand that will stoke the first quarter or two of 2022 in terms of volume.”

Deal composition shifts

One significant change in FY 2021 over the prior year was the big uptick in the number of 232/223(a)(7) loans, which are refinancings of existing HUD-insured loans on healthcare properties.

Of the 328 loans closed during FY 2021, 147 were 232/223(a)(7) loans totaling $1.83 billion, or nearly 47 percent of the total deal volume for the year. By comparison, lenders closed 54 such loans in FY 2020 for a total of $638.5 million, or about 15 percent of total annual deal volume.

“As opposed to a loan modification, where all you can do as a borrower is reduce the rate, the (a)(7) allows you to both lower the rate and extend the loan maturity term,” says Michael Gehl, chief investment officer at Housing & Healthcare Finance.

“The (a)(7) also allows you to include payment of any prepayment penalties through increases in the loan balance, not to exceed the loan balance at the closing of the original FHA loan. For the deals that we’ve looked at, the net impact of the (a)(7) is typically twice the savings versus a loan modification,” emphasizes Gehl.

Not out of the woods yet

Howard of CFG says several sources have told him that the seniors housing industry is through the pandemic stage of COVID and moving toward the endemic stage. “It’s just something that we’re going to have to live with and deal with in every aspect and walk of life unfortunately, like a bad flu.”

The headwinds that the senior housing industry has run into, particularly in the skilled nursing sector, aren’t likely to dissipate overnight, however.

“If you look at what has happened from the start of the pandemic, skilled nursing occupancy on average dropped from 80 percent to 67 percent, picking up about 500 basis points since January to about 72 percent currently,” points out Gehl.

“The federal government has provided direct stimulus, loan forgiveness programs, waiver of the three-day hospital stay thereby allowing a nursing home to ‘skill in place’ under Medicare, removal of sequestration, and some states have provided enhanced Medicaid reimbursement,” explains Gehl.

Consequently, skilled nursing facilities have been able to weather the storm in many cases. However, from a cash flow underwriting perspective, a number of these programs are temporary and need to be backed out of the underwriting analysis, as do some one-time expenses incurred during the height of the pandemic, according to Gehl.

“Depending upon your occupancy assumptions, underwritten cash flow is down, and therefore values and loan proceeds are down. The same can be said about assisted living facilities as occupancy fell about 9 to 10 percent on average and is up about 2 to 3 percent from the nadir. Labor and supply costs have increased as well with much less government stimulus available.”

Consequently, many 232/223(f) loans that would underwrite just fine pre-pandemic are currently not doing so, explains Gehl. What’s more, turnaround bridge loans that were structured to be taken out by HUD once a repositioning occurs, are taking longer to achieve the needed cash flow for a refinance.

Still, there were 178 loans closed through HUD’s 232/223(f) program in FY 2021. For example, Lument provided $8.3 million in 223(f) financing for Gardens of Morningstar, a 106-unit assisted living community in Oswego, New York, located along Lake Ontario north of Syracuse. The deal closed in January 2021.

The property was vacant until 2016, when current ownership acquired and substantially renovated the building. Lument helped ownership structure a bridge loan in 2017 that consolidated construction debt and positioned the facility for a HUD/FHA refinance. The new loan paid off the existing bridge loan and reimbursed the borrower for previous capital expenditures.

The loan featured a fixed interest rate and 35-year term. Miles Kingston, vice president in Lument’s Philadelphia office, led the transaction.

Lument, whose parent company is Orix Corp. USA, closed $220.7 million in loans through the HUD 232 program in FY 2021, making it the sixth-largest originator for the year.

What keeps him up at night?

The staffing issue will be the big hurdle to clear in the next year, says Greystone’s Thurman, who is encouraged by the creativity that operators are bringing to the table to attract talent.

During the annual conference of the American Health Care Association and the National Center for Assisted Living that took place in Nashville in October, Thurman spoke with several operators who say inadequate staffing is partly to blame for their struggle to boost occupancy rates at facilities.

“It’s not so much that there is not demand for the beds. It’s that they can only staff so many beds in the skilled nursing world,” says Thurman.

A few operators also told Thurman they were being “gouged” by contract nurses whose services are open to the highest bidder.

Thurman is concerned about a possible rise in premiums for property and casualty insurance because of natural disasters nationally such as wildfires, hurricanes, tornadoes and floods.

Professional liability insurance is another area Thurman is monitoring closely. In April, former New York Gov. Andrew Cuomo repealed a law that shielded nursing homes and other essential businesses from coronavirus-related lawsuits, according to the New York Post.

Proponents of the governor’s decision to repeal the law have argued that the blanket immunity had unfairly prevented thousands of families who lost loved ones due to COVID-19 from seeking legal recourse.

“Seeing those claims rise is going to drive up the cost of that insurance, and we’re going to spend more time on waivers or tort reform to resolve the issue,” says Thurman.

Thurman’s third insurance concern centers on workers’ compensation.

“When you look at the number of staff who have contracted COVID, fortunately not many have died. But I’m sure there are some examples out there.”

Let’s say a caregiver is required to come to work but no mask is available and that worker contracts COVID, that would be grounds for a claim, he points out.

“These types of incidences, which could ultimately have a financial impact, are issues we are tracking when evaluating owner/operator strength,” says Thurman.