CHICAGO — Focus Healthcare Partners LLC has completed the final closing of Focus Senior Housing Fund II LP, a closed-end, commingled, discretionary real estate fund targeting private-pay seniors housing. The fund raised approximately $370 million in capital commitments. The fund is 20 percent larger than its predecessor vehicle despite a challenging fundraising period for commercial real estate, thanks to strong support from new and existing limited partners, according to Chicago-based Focus. Investors in the fund include university endowments, state and corporate pension funds, insurance companies, wealth managers, family offices and …

Investment

DALLAS — While active adult has certainly gained a much higher profile in the last decade, it’s still seen by most as a niche — and perhaps mysterious — segment of commercial real estate. Many multifamily investors may be scared off by the slow lease-up and smaller potential resident pool, while private-pay seniors housing owners scoff at the comparatively lower rents. As the 55-plus rental model is one of the newest types of real estate, many of active adult’s advocates on the investment side say educating potential buyers is an …

With operating fundamentals on the rise and demographics on their side, this growing group of investors in seniors housing believes the stars are aligned to achieve healthy returns. By Jane Adler While some longstanding private equity groups in seniors housing remain on the sidelines as they work through the operational challenges created by the COVID-19 pandemic, others are making investments in the sector. Fund managers are raising capital and seeking investment opportunities. New private equity players are emerging. And more private equity groups are entering into joint ventures and forging …

CHICAGO — Senior Lifestyle, a Chicago-based owner-operator, has hired John Rimbach as chief investment officer. With more than 30 years of experience in the senior living industry, Rimbach will spearhead the company’s investment strategies and financial growth trajectory. Prior to joining Senior Lifestyle, Rimbach served as president of healthcare facilities at Health Care Trust Advisors LLC. In this role, he managed diverse portfolios and executed winning investment strategies in the senior living space. As the founder and CEO of West Living LLC, Rimbach drove operations and optimized financial performance. In …

LOS ANGELES — In 2023, particularly in the second half of the year, a combination of forces slowed property sales to a crawl in the seniors housing sector. Amy Sitzman, executive managing director of seniors housing and care at Blueprint Healthcare Real Estate Advisors, laid out the laundry list of challenges. “The bid-ask spread conversation really has everything to do with what’s gone on in the market the past year and a half,” she said. “It has been trying for everybody dealing with interest rate hikes, inflation, operations, staffing challenges, …

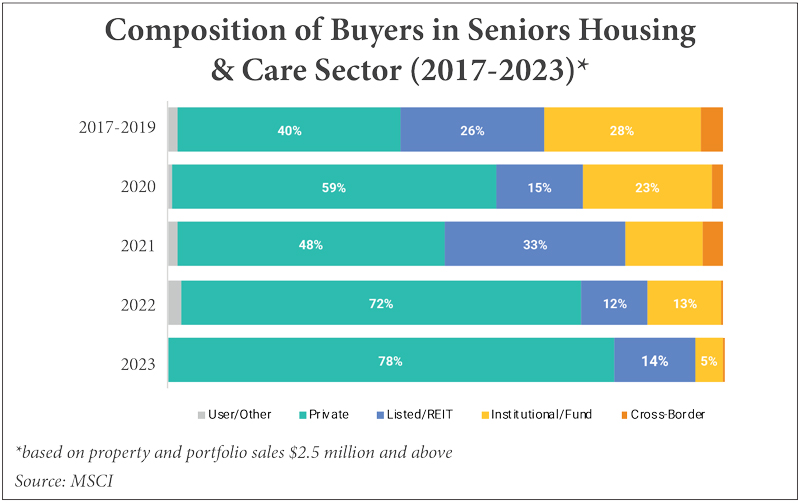

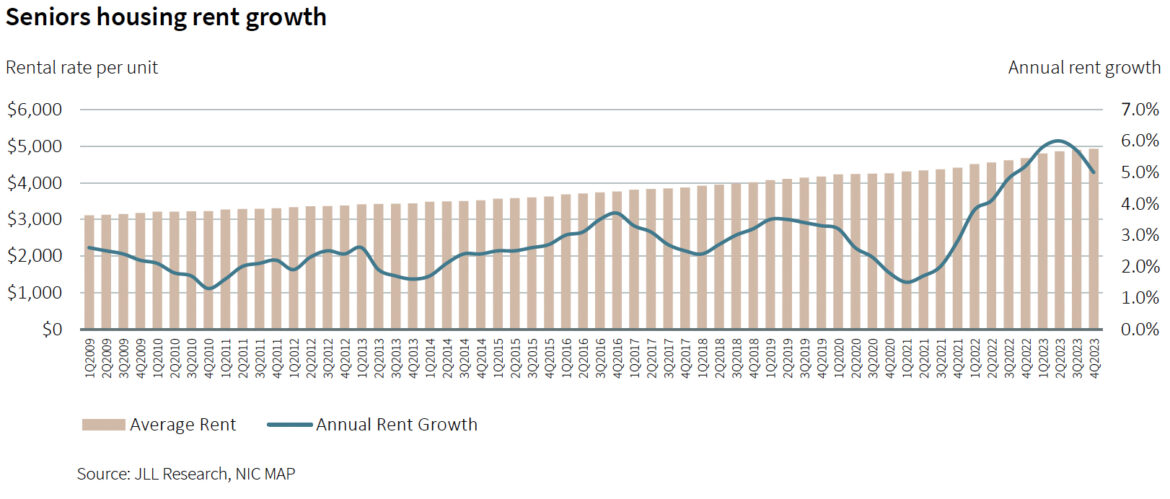

CHICAGO — Green shoots are starting to emerge in the capital markets, benefiting the seniors housing sector of the industry. The underlying market fundamentals continue to bounce back from the lows experienced during the COVID-19 pandemic with occupancy increasing, construction starts slowing and the market showing signs of stabilization and growth, according to JLL’s seventh annual Seniors Housing and Care Investor Survey and Trends Outlook. Of the investors surveyed for the report, 63 percent of respondents indicated they would increase their investment exposure to seniors housing in 2024, which is up …

IRVINE, Calif. — American Healthcare REIT Inc., a formerly private REIT focusing primarily on medical office buildings, seniors housing, skilled nursing facilities, hospitals and other healthcare-related facilities, has announced plans for its public offering of 56 million shares of its common stock. The initial public offering price is expected to be between $12 and $15 per share. The company’s common stock has been approved for listing, subject to official notice of issuance, on the New York Stock Exchange under the symbol AHR. Irvine-based AHR intends to use the net proceeds …

Seniors housing acquisition and development is a costly business these days. Inflation has increased the price of construction materials, and wage pressures are driving up personnel costs. And after nearly two years of interest rate hikes to slow inflation, debt service on short-term construction and bridge loans is straining borrowers’ budgets and potentially threatening their ability to qualify for take-out financing when their properties reach stabilization. That is, if they can even source a long-term mortgage from increasingly risk-averse regional banks distracted by today’s market volatility, says Jason …

The Dec. 7 webinar “What Will 2024 Hold for Seniors Housing Investment & Acquisition Activity?” covered where the industry stands now and how experts are preparing to succeed in 2024. Webinar panelists listed factors like interest rates, wages, insurance costs, inflation, margin compression, resident move-ins and bank short sales as market indicators for the health of seniors housing. Learn their outlook and forecasts for what the industry may face in the new year. The speakers covered transaction activity, cap rate trends, capital availability and pricing, as well as the …

CHICAGO — Welltower CEO Shankh Mitra believes it could be a few years before seniors housing development will once again be feasible for the giant healthcare REIT to undertake because of strong headwinds facing the industry, including the “out-of-control” cost of construction. Construction costs have increased 50 percent or more over the past five years, according to Mitra. “I don’t see how that [cost] comes down meaningfully unless we solve the labor situation.” There were 363,000 job openings in the construction industry at the end of July, up 10,000 from …