Investors and customers are increasingly drawn to companies that embrace environmental, social and governance policies, but the success of these initiatives hinges on transparency and authenticity.

By Jeff Shaw

A company could be forgiven for wanting to avoid developing and implementing an ESG (environmental, social and governance) strategy. Enacting concrete policies to address the desired goals in these areas, then tracking and reporting results to stakeholders, is a time-

consuming and costly process.

For background, the “environmental” piece of the equation relates to how a company operates in a way that is environmentally conscious or addresses climate change. The “social” component refers to managing relationships with employees and customers, while “governance” is about how the company is led from the top.

For now, at least in the U.S., a smaller seniors housing company might be able to get away without spending too much time on ESG issues. But those days are numbered, according to Greg MacKinnon, director of research at the Pension Real Estate Association (PREA), a nonprofit trade association for real estate investors.

“There is a range of strategies among investors in the U.S. Some take ESG very seriously. Some know they should, but don’t know how to do it yet. Some don’t care. That last group is getting smaller and smaller.”

MacKinnon’s comments came during a panel titled “Calling All Capital Providers & Operators: What Senior Living Needs to Know About ESG” at the NIC Fall Conference, held in September in Washington, D.C.

Other panelists included Jill Brosig, managing director and chief impact officer at Harrison Street, an alternative real assets investor; Kathy MacDonald, senior vice president of investor relations at Brookdale Senior Living, the largest seniors housing operator in the country; and Isela Rosales, managing director and head of ESG and sustainability at Bridge Investment Group, an investor and developer.

“Even six years ago, if we had done a panel on ESG, it would’ve been the front row filled with people while the rest would say, ‘I’m going to get back to my email now,’” joked MacKinnon. “Now every conference we hold, people want to talk about ESG. It’s a top-of-mind issue for institutional investors and investment managers.”

REITs lead the way

Many of the large, publicly traded companies in seniors housing have taken the lead on implementing solid ESG policies. As part of her ascension to the CEO role at Brookdale in 2018, Lucinda Baier started strengthening that part of the company, according to MacDonald.

“As an operator with over 35,000 employees, the social aspect is extremely important for our associates,” said MacDonald during the panel discussion. “With regulations regarding climate change, the environmental aspect is becoming more important to us. We pull it together as an annual report. We share what we’re doing — it helps us to plan for the future.”

That report, released in April each year, uses Sustainability Accounting Standards Board (SASB) benchmarks, combining its recommendations for both healthcare and hospitality properties.

For their part, REIT giants Ventas and Welltower each release their own ESG reports. Welltower cites both “investor expectations and employee engagement” as reasons for embracing ESG.

Sabra Health Care REIT, the publicly traded owner of nearly 100 seniors housing properties, describes its ESG initiatives “as an investment, not a check-the-box exercise,” according to CEO Rick Matros.

“Environment, social responsibility and governance are foundational principals critical to the success of our business and our stakeholders — now, and even more importantly in the future. The question to us is not how important these principals are, but rather how effectively we can integrate them into the strategy of our business so they become self-sustaining and accretive.”

Not only are REITs taking the lead on ESG, but Matros said that’s part of their duty to operators.

“We believe REITs are uniquely positioned to support these initiatives with scale, experience and access to capital. The cherry on top is that many of these investments will also improve the lives of the residents and working environment for the employees — these investments can be a win-win-win situation, explained Matros.”

Embrace the environment

The “E” in ESG may be the no-brainer of the group. That’s because many of the initiatives are about more than just sounding good. Being environmentally conscious is helpful to marketing to potential residents and can cut expenses in areas such as utilities.

“As I speak to investors that are considering allocating to funds, they only want to talk about environmental — how to reposition assets, make them more efficient and spend dollars that make sense and drive to the bottom line,” said Rosales. The most common targets are LED lighting and energy-

efficient appliances, she added.

It’s also the easiest aspect of ESG for companies to wrap their heads around.

“I don’t want to say the ‘E’ part is the easy part — there are a lot of hard details to sort out there — but people are in basic agreement of what the goal is,” said MacKinnon.

But it’s not just a matter of installing LED lights. Companies have to strategize, execute that strategy, and track and report the results. For example, Sabra invested $1 million in environmental initiatives such as water conservation and efficient lighting and HVAC in 2022.

“Based upon our initial success and progress, we are now expanding this opportunity to our triple-net tenants in a program we call Green Links,” said Matros. “Under Green Links, we work collaboratively with our tenants to collect, measure and assess their energy- and water-efficient improvements. This partnership will not only benefit the environment, but can significantly reduce operating costs, enhance the work environment for the employees and improve the lives of the residents.”

“Many of these improvements are self-financing, where the annual savings exceed the amortized cost,” added Matros. “To this end, we have approved an initial fund of $5 million to help finance and support these programs for our tenants.”

Brosig said Harrison Street plans to reduce carbon emissions by 70 percent by 2025. She noted that it’s important to be transparent and genuine about environmental objectives in order to avoid “greenwashing” — paying lip service to sustainability as a marketing message, rather than truly acting to limit a company’s environmental impact.

“It’s a lot of work, but it’s really important to be transparent around what you’re doing with ESG,” said Brosig. “You want to be in a position that if you say you’re going to do something, report out on what you’ve done and how you measure up against your metrics. People want to make sure that you’re genuine and that you truly are making inroads at whatever goals you have.”

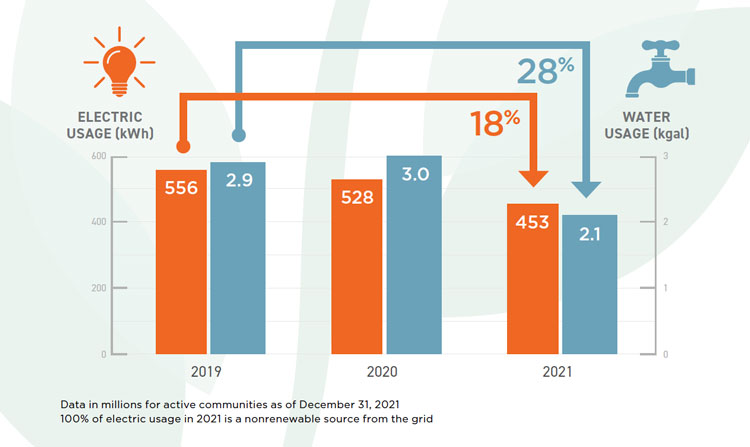

Brookdale’s 2021 ESG report indicated the company spends an average of $177 million per year in community improvements across its portfolio related to reducing environmental impacts. Between 2019 and 2022, the company reduced its electric usage by 18 percent and water usage by 28 percent. MacDonald said Brookdale is Energy Star-certified at 500 of its communities.

“We figured out what we wanted to measure, then realized we had the staff in-house,” she said. “Facility management really handles a lot of our environmental metrics gathering.”

ESG’s effect on the front lines

The “S” in ESG is where things get more complicated — but also where more outside help is available. Certifications such as WELL and Fitwel exist to help draw a roadmap for companies to improve their levels of social responsibility.

“A rising body of research shows that investing in healthy buildings has multiple benefits, including increasing people’s satisfaction with their workplaces, improved well-being and increased employee productivity,” said Matt Trowbridge, chief medical officer of the International WELL Building Institute. “Healthy buildings support stronger financial returns, including rent premiums, faster leasing speed and longer lease terms.”

Brosig said that Fitwel’s senior living-specific standards originated in 2019, when Harrison Street collaborated with the Center for Active Design (CfAD) to create a specialized healthy building scorecard specific to seniors housing.

“They were really excited to do something in the seniors space. It was a population they had yet to consider,” she said. “This is not a Harrison Street scorecard, but a senior living industry scorecard that anyone in the business can utilize.

“One thing I love about ESG is being collaborative, not competitive. The only way we’re going to win is if we all do this together. We’re always very open to share with others what we’ve done. I can design buildings to have net zero [environmental impact] and handle anything that the climate throws at me. But if I’m the only one out there with net zero buildings, it’s not going to move the needle.”

Sabra uses WELL certification, and noted that while tenants already had many of its social initiatives in place, certification allows operators to get credit for those efforts — and market those to both employees and residents. Operators Enlivant and Claiborne Senior Living, which are both Sabra tenants, have their full portfolio WELL Health-Safety rated.

“In our mission statement, we state our commitment to enhancing the lives of our employees, residents and families we serve. The WELL Health-Safety Rating recognizes commitments to promoting safer and healthier environments for employees and residents. It seemed to be a natural alignment,” said Tim Dunne, president of Claiborne.

“As we learned more, we realized the standards set by this certification would raise the bar for our communities and help us provide a healthier environment for our employees, residents and family members,” added Dunne.

“The WELL Health-Safety seal helps senior living facilities communicate to their audiences with confidence that they follow best practices and that people’s health and well-being have been prioritized,” added Trowbridge.

As far as what social initiatives look like in practice, in its 2022 ESG report, Ventas said it is seeking to increase the diversity of its employee candidate pool, expand its diversity metrics and tracking capabilities, increase the representation of women in senior leadership and send a DEI (diversity, equity and inclusion) sentiment survey to employees.

The company also launched an unconscious bias diversity training program, expanded its relationships with historically black colleges and universities (HBCUs) to introduce itself to a wider audience and increased its efforts to highlight its employees on social media.

Another aspect of Ventas’ social programming included improving its benefits package, offering expanded leadership training and on-demand learning, implementing a hybrid work schedule and auditing the safety of its buildings.

Harrison Street — which also invests in student housing — has a program named StudentCare through which college students living in a student housing property volunteers or takes paid shifts at a seniors housing community.

“Both seniors and students are some of the loneliest populations we have right now,” said Brosig. “We no longer live in a society where grandparents live in the same household as their grandchildren. Being able to provide a program that supports, encourages and emphasizes intergenerational connections is proven to be beneficial to each population’s mental health.”

Outside of the social part of ESG, DEI efforts also tend to be at the core of governance — the “G” in the acronym. What does the corporate office look like as far as diversity?

Industry associations Argentum, ASHA and NIC joined with Ferguson Partners in 2022 to undertake a survey of 44 companies within the industry. The survey found that while only 37 percent of respondents have a formal DEI program, 46 percent have implemented initiatives and/or policies and 56 percent have a formal DEI committee for developing, implementing and reviewing strategies.

Over 90 percent of respondents focus on increasing diversity, particularly in the areas of gender, ethnicity and sexual orientation.

The social and the governance aspects of the survey intersect in one important way. While the companies surveyed employed 46 percent people of color, only 17 percent of executive management teams were of color. This gap between the frontline racial makeup and the corporate teams are where many are looking to improve.

MacDonald noted that Brookdale now uses its DEI programs as a selling point in recruiting materials, as younger employees want to know about it.

How do we get started?

Of course, for smaller companies that are relatively new to the concept of ESG, creating policies around it can be intimidating.

To assist those starting out, PREA partnered with the National Council of Real Estate Investment Fiduciaries (NCREIF) to release a worksheet for beginners to track key performance indicators.

MacKinnon of PREA also suggested that companies pursuing ESG policies can lean on consultants that specialize in this initiative, although he also cautioned business leaders against working with just anyone.

“If you’re at a small shop with nine employees, you won’t have eight of them doing ESG. For firms just starting their journey, if you’re willing to spend money, there’s somebody willing to take it from you. So, decide up front what it is you want help with. Do you want help with data-gathering mechanisms, or filling in forms, or the nitty-gritty engineering of increasing efficiency?”

The PREA worksheet is available for free on its website.

MacDonald said Brookdale began the adoption process by asking investors what they wanted to see from the company when it comes to ESG.

“It can get overwhelming, especially at the beginning. Doing your own assessment is the most important, then go out to your stakeholders,” she said. “It’s important to be realistic. First you need to get your baseline metrics, then take that step by step and get better.”

Similarly, Harrison Street started small, then slowly built out its ESG team, said Brosig.

“When we first started our program in 2013, we relied on consultants to help with reporting and build our overall strategy. Since then, we have built a fully dedicated team whose entire job is to work on ESG.”

Harrison Street does still use consultants, but for specific areas such as reporting and energy efficiency assessments, added Brosig.

“The internal team continues to evolve in their role as ESG becomes an increasingly relevant issue. Much of the team’s time is spent on institutionalizing the strategy. We will only be successful if the ESG strategy is aligned with key stakeholders, including employees, tenants, residents, operators, partners and investors.”

Rosales said she was a one-woman show when Bridge Investment Group began its ESG initiatives. The firm hired a consultant for an initial assessment, then built out a team and got the company on track.

“I still go back to that assessment because [the consultant] gave me a roadmap — where we should be year one, two and three. That helped me lose less sleep knowing how I could set myself up for success,” explained Rosales.

“Even if you feel overwhelmed to start, you just need to start somewhere. There’s often a sense of ‘wait until we have something big to tell,’” added Rosales, “but it’s going to be a journey. It takes time.”