DENVER — Endeavor Senior Living has officially launched, with plans to invest $500 million into North American seniors housing assets with a focus on value-add opportunities. The principals of Endeavor encompass over 50 years of experience in seniors housing, behavioral health, real estate development and investments, capital markets, hospitality, branding, marketing and sales. “Building upon our deep perspective into investments, capital markets and operations, Endeavor is poised to capitalize on opportunities to better serve seniors today and for decades to come,” says Kyle Beard, co-founder and managing partner. “Rooted in …

Investment

MIAMI — Lloyd Jones, a Miami-based investor, has added four members to its seniors housing team. Sarah Curatella was hired as regional vice president of health and wellness for senior living. She has over 28 years of experience as a registered nurse and assisted living administrator in Alabama. She is also a Certified Legal Nurse Consultant. Brian Griffith was hired as regional director of senior living sales. He has 14 years of experience in healthcare sales, leadership and business development. Linda Pisacano was hired to the senior living transition team. …

As if seniors housing developers and operators did not have enough difficulties rebounding from the pandemic, what with constrained occupancy, elevated expenses and staffing shortages plaguing the sector, they are now navigating an environment where the rising cost of capital is limiting their financial flexibility. While the 10-Year Treasury yield has retraded about 50 basis points from its recent peak of nearly 3.5 percent in mid-June, it is still twice as high as it was at the beginning of the year. Likewise, the secured overnight financing rate (SOFR) has shot …

COSTA MESA, Calif. — Ziegler has advised CareConnectMD (CCMD), a Costa Mesa-based provider of primary care coordination services tailored to meet the needs of complex Medicare participants, on its $25 million financing round led by Minneapolis-based TT Capital Partners (TTCP). CareConnectMD will leverage the investment to deepen its presence in California, Ohio and Texas and expand into other markets while enhancing its technology platform to scale and streamline care delivery. CCMD’s California-based medical group contracts with managed care and insurance plans to provide comprehensive primary and palliative care to high-risk …

Unitranche loan programs blend senior and junior debt pricing and terms into a single, first lien debt facility — a single financing that replaces the multitranche debt approach. The unitranche arrangement provides the benefits of a fully levered mezzanine debt structure, while the single financing structure streamlines the agreement and costs for borrowers. KeyBank Real Estate Capital, the commercial real estate business unit of KeyCorp, recently partnered with Welltower to establish a unitranche loan program with $750 million in lending capacity for seniors housing and skilled nursing facilities. Industry expertise …

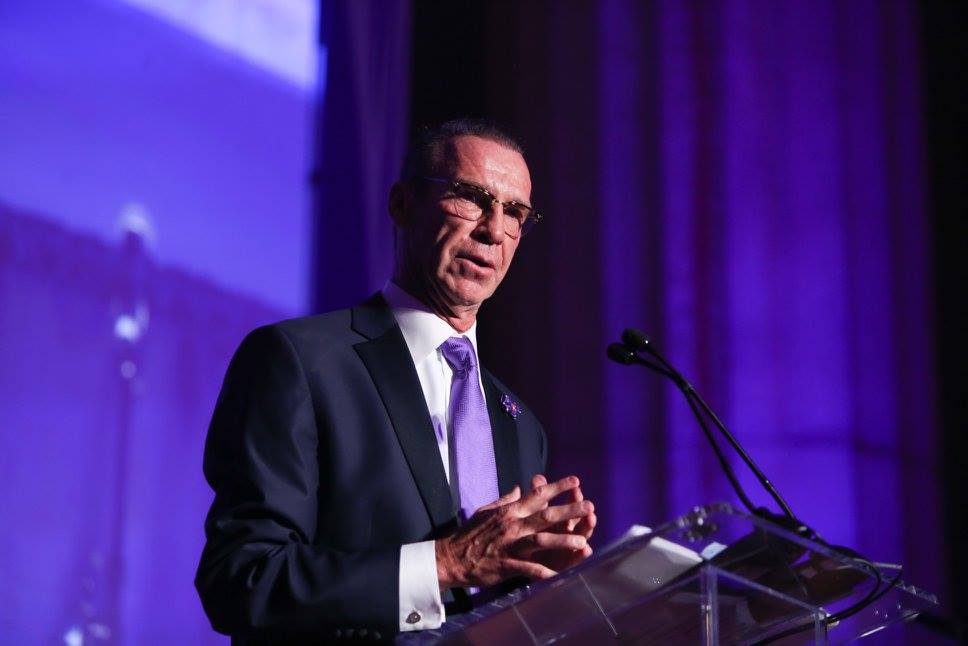

Longtime investor seeks technologies that will transform the way seniors and healthcare intersect. By Jeff Shaw Though his career has largely focused on the capital markets end of seniors housing, Arnie Whitman is much more than just a money man. “It’s more about making a difference than making a buck,” he says. Whitman entered the seniors housing industry in 1984 when he was hired to lead an acquisitions team for real estate investor and nursing home magnate Abraham Gosman. The company, Meditrust, was trying to go public. Although Whitman had …

How do you know whether to keep your powder dry or jump back into the investment/development markets? Buying, but not building Rick Shamberg Managing Director Scarp Ridge Capital Partners Our firm has taken a bullish approach to the acquisition market in senior living and a more conservative approach to development opportunities. Given the dislocation and interruption stemming from the pandemic, including pressure on sponsors (which in some cases has translated to more reasonable valuations), pent-up demand from consumers, high construction costs for new development, and a general lack of new …

Webinar: Inflation and Rising Interest Rates – Doom or Boom for the Seniors Housing Industry?

Seniors housing valuations — what can the industry expect in terms of future occupancy, inflation and interest rates? These were the most pressing topics of the “Inflation and Rising Interest Rates — Doom or Boom for the Seniors Housing Industry?” webinar, hosted by Seniors Housing Business and sponsored by V&IG. Hear how expert panelists are accounting for some of the most challenging questions in today’s market: What is driving investment in this space? How have return expectations changed since the beginning of the pandemic? How are increasing interest rates and/or inflation impacting …

BOCA RATON, Fla. — Kayne Anderson Real Estate, the real estate investment arm of private equite firm Kayne Anderson Capital Advisors, has closed its latest at an oversubscribed level of nearly $1.9 billion. The fund, Kayne Anderson Real Estate Debt IV (KARED IV), is run through the company’s debt platform KA Real Estate Debt. The fundraise, having received strong support from a diverse group of existing and new investors, surpassed its original target of $1.5 billion. KARED IV seeks to generate risk-adjusted returns in structured real estate finance, leveraging KA …

IRVINE, Calif. — Avanath Capital Management LLC, an Irvine-based multifamily owner and operator that focuses on affordable and workforce housing, including for seniors, has promoted current CFO Wesley Wilson to partner. The move makes Wilson the youngest partner in the firm’s history. In addition, Patricia Gaudin was promoted from senior vice president of human resources to executive vice president of human resources. Wilson will be responsible for managing the firm’s new open-ended fund with over $536 million in equity commitments, serving as the firm’s sole investment vehicle moving forward. Coupled …