Although these funds collectively have raised billions of dollars, they are in no hurry to spend the capital amid dicey market conditions. By Bendix Anderson Talk about patient capital. Many private equity funds, flush with hundreds of millions of dollars, are willing to wait and wait for the right deal at the right price before acquiring a seniors housing property or portfolio. At the same time, private equity investors are spending more than ever before to buy or build conventional apartments. They’re even snapping up alternative niche properties — from …

Investment

CHICAGO — Backed by strong long-term demand and increased investor interest, the seniors housing sector is now fully in recovery mode, according to JLL’s Valuation Advisory group’s fifth annual Seniors Housing Investor Survey and Outlook. The survey also revealed that investors are bullish on the seniors housing and care sector as a result of the projected “silver tsunami” of retired baby boomers and expected subsequent supply shortage. The survey had more than 100 respondents, all transactional professionals who specialize in the seniors housing and care space. The Chicago-based firm released …

1031 Crowdfunding Acquires Memory Care Portfolio as Opportunity Fund Reaches Full Subscription

IRVINE, Calif. — 1031 Crowdfunding, an Irvine-based real estate investing platform, has fully subscribed its $16.9 million 1031CF Portfolio 1 DST. This is the company’s sixth investment in senior living care facilities. The fund was used to acquire two memory care communities. Iris Senior Living is the operator of both properties, which are located in the Dallas-Fort Worth and Oklahoma City metro areas. The facilities include a combined 88 beds and 76 units, and are currently 91 percent occupied. 1031 Crowdfunding’s affiliate, 1031 CF Properties LLC, created the investments to …

CHICAGO — Green Courte Partners LLC, a Chicago-based private equity firm that includes seniors housing has promoted eight of its team members. The company promoted Jon Pollan to managing director of acquisitions and Josh Reichert to managing director of portfolio management. Pollan joined Green Courte in 2013 as an associate focusing on acquisitions and asset management. He was promoted to senior associate in 2015 and vice president in 2018. As a managing director, Pollan will be responsible for sourcing and leading new acquisitions for Green Courte’s near-airport parking company, The …

SALT LAKE CITY — Bridge Investment Group Holdings Inc. (NYSE: BRDG) has launched a $75 million program to acquire, develop and operate needs-based seniors housing assets within the United States. As part of the venture, StepStone Real Estate co-invested in an existing portfolio managed by Salt Lake City-based Bridge and intends to help build the platform by co-investing in other seniors housing assets identified by Bridge in the future. “Bridge’s partnership with StepStone represents a strategic milestone as we continue to expand our needs-based seniors housing strategy,” says Robb Chapin, …

MORRISVILLE, N.C. — K4Connect, a Morrisville-based health technology company that builds tech for older adults, has received $12 million in additional venture financing since the beginning of the COVID-19 pandemic. The credits the “undeniable need for dependable and scalable resources that can support the older adult population with easy access to important information, socialization tooling, communications and safety.” New investors include Forte Ventures, Second Century Ventures (National Association of Realtors), and senior living industry leaders such as Daniel Decker, president of CoastWood Senior Housing Partners; William Petty, BPOC founder and …

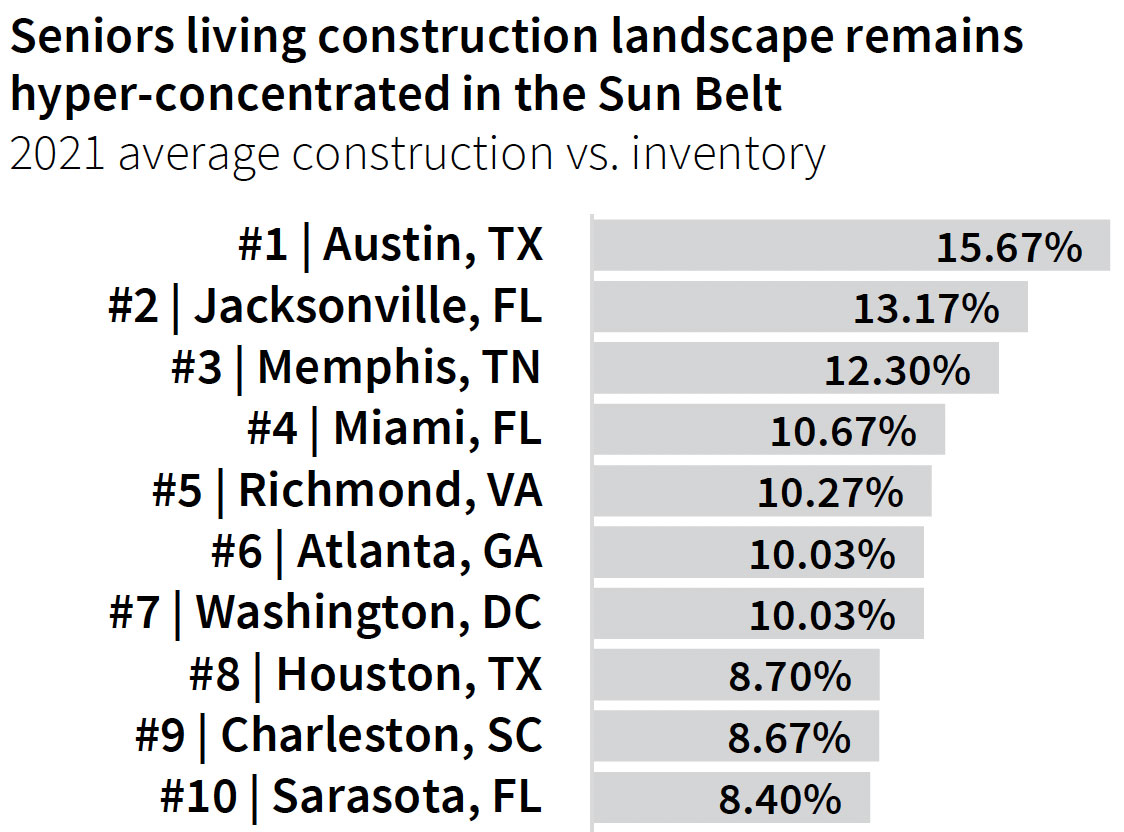

Occupancy trends, the impact of the Omicron variant, development, investment, vaccine mandates and labor shortages were just some of the pressing topics panelists discussed during the “Seniors Housing Policy Outlook: What Will Impact Operations, Investment & Development in 2022?” webinar, hosted by Seniors Housing Business. Industry experts weighed in on the policies and priorities shaping the future of senior living communities, as well as their own legislative agendas for 2022. Regarding investment and development, Dave Schless, president of American Seniors Housing Association (ASHA), explains Capital markets have remained committed and robust …

IRVINE, Calif. — Sabra Health Care REIT Inc. (NASDAQ: SBRA) has entered into a definitive agreement to amend the company’s master lease with a tenant, Avamere Group. Avamere’s annual base rent on the current portfolio has been reduced roughly 30 percent to $30.7 million from $44.1 million. No changes have been made to the lease maturity date (May 31, 2031) or the annual base rent escalator (2.75 percent). Sabra plans to recapture this rent reduction as the portfolio’s performance improves. Starting with the second lease year, Sabra will participate in …

Some investor types have doubled down while others have fled seniors housing as the COVID-19 pandemic enters its third year. By Jeff Shaw COVID-19 has changed many investors’ approaches to the seniors housing sector. The pandemic caused a major shift in who’s buying and who’s selling. Some of the biggest buyers in 2019 were the biggest sellers in 2021. For example, institutional investors went from buying more than $2 billion in 2019 to selling more than $3 billion through the first three quarters of 2021. That’s according to Real Capital …

A variety of partnerships and lease structures present many options for landlords and tenants to both benefit. By Jeff Shaw In the retail real estate world, triple-net leases are king. Under this standard agreement, the tenant is responsible for all expenses — taxes, insurance, maintenance, utilities and rent to the owner. But seniors housing is a very different type of real estate. In retail, if a tenant fails, the owner simply finds a new one. For senior living, there’s a human element at play both for the employees and the …